Investing For Beginners Uk

Discovering the world of investing can often feel like stepping into a whirlwind of jargon, intimidating industry experts, and a plethora of confusing options. If you’re based in the UK and looking to dip your toes into the investment pool, you’re in the right place. The UK finance market offers a reliable yet diverse landscape for beginners to start building their financial future. As the adage goes, “The best time to plant a tree was 20 years ago. The second best time is now.” So, there’s no better time to start than today – let’s delve into investing for beginners in the UK!

Read More : Top 10 Safe Investments For Long-term Growth

The first step in your investment journey should be understanding why you want to invest. Maybe you’re looking to build a retirement fund, save for a child’s education, or simply grow your wealth. Identifying your goals is key because it will influence your investment strategy. Begin with the manageable; start small to minimize risk until you gain confidence and experience. Investing isn’t about getting rich quickly; it’s about building wealth steadily over time. Patience and discipline are virtues that go hand in hand with investment success.

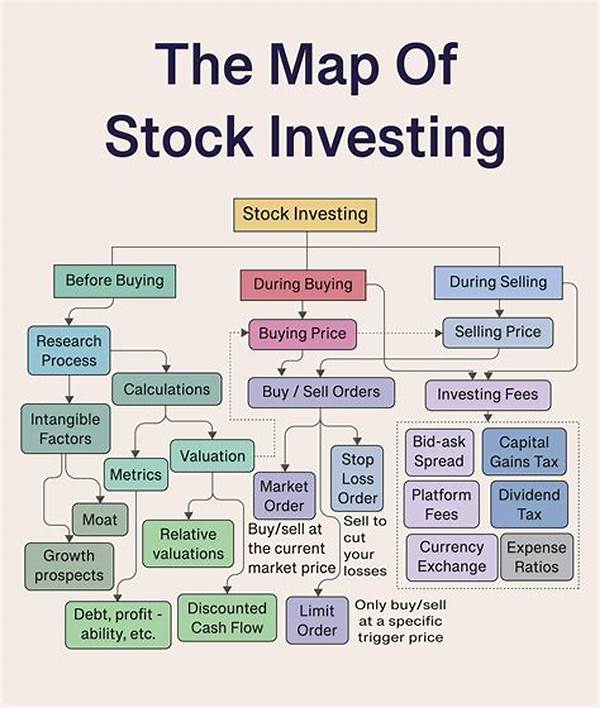

To make informed decisions, equip yourself with knowledge. The investment world is vast and varied, from stocks and bonds to ISAs and peer-to-peer lending in the UK – each comes with its own lingo and rules. Therefore, learning the fundamental concepts, such as diversification, compound interest, and risk tolerance, is critical. An educated investor is an empowered investor; after all, knowledge is the most valuable currency when it comes to investing for beginners in the UK.

Key Steps to Begin Your Investment Journey in the UK

1. Education and Research: Understanding the various investment vehicles available in the UK and identifying which ones suit your risk tolerance and financial goals.

2. Setting Financial Goals: Clearly defining what you aim to achieve with your investments, whether it’s retirement, saving for a big purchase, or building a safety net.

3. Choosing the Right Platform: The UK offers numerous platforms for investing, from traditional brokerage accounts to online trading apps. Consider factors like fees, ease of use, and available resources.

4. Starting Small and Diversifying: Begin with small investments to learn the ropes without exposing yourself to significant financial risk. Diversify your portfolio to mitigate risk.

5. Regularly Review and Adjust: Your investment strategy should not be set in stone. Regularly review your portfolio and adjust your strategy as needed to stay aligned with your financial goals.

Introduction to Stocks and Shares

To bring the investment conversation closer to home, let’s talk about stocks and shares. The UK stock market is a treasure trove of opportunities for beginners. But what exactly are stocks and shares? In simple terms, buying stocks means purchasing a slice of a company. As a shareholder, you hold a fraction of the company’s assets and earnings. The value of shares can rise or fall depending on the company’s performance and market conditions. This forms the basis of learning to play the stock market game effectively as an investor.

With shares, the potential for profits comes from dividend payments and capital appreciation. Dividends are portions of a company’s profit distributed to shareholders, while capital appreciation refers to the increasing value of a stock over time. Both can contribute significantly to building wealth when managed wisely. Don’t let fear of loss keep you out; instead, recognize and manage potential risks to your advantage.

Always remember, when it comes to “investing for beginners UK,” doing your homework, setting clear goals, and selecting the right mix of investment vehicles are fundamental principles. The journey might seem daunting, but with the right mindset and persistent effort, you can begin your path to financial growth and security.

—

Starting your investment path can feel overwhelming, yet it’s an advantageous step towards your financial well-being. For newcomers in the UK market, understanding the nuances of investing is crucial. With diverse options available, navigating these waters might be simpler than it seems.

In the UK, beginner investors are often advised to start with something simple and accessible, such as a Stocks and Shares ISA. This tax-efficient account allows for investment in a wide array of resources like individual stocks, bonds, funds, and even cash equivalents, providing an enticingly easy way for beginners to enter the stock market without heavy tax burdens.

Understanding Risk and Reward

The balance between risk and reward is an essential element of investing. In the UK, financial markets offer various options with differing risk levels. It’s typically recommended for beginners to opt for safer choices initially, gradually escalating to higher risk investments as experience and confidence grow. Possessing appropriate knowledge and a clear understanding of the intrinsic risks allows investors to make informed, well-rounded decisions that lead to long-term gains.

The Role of Financial Advisors in Beginner Investing

In some cases, consulting with financial advisors can be beneficial. These professionals can offer invaluable insights and strategies personalized to your financial situation and goals. By providing clarity on complex investment concepts, they ensure your decisions are made with precision. This guidance can be a game-changer, making investing for beginners UK not just a possibility but an exciting prospect.

Moreover, the role of technology and digital platforms in easing the entry to investing cannot be understated. Many brokerage firms in the UK offer beginners a host of e-learning resources and guides to demystify investment procedures. These resources aid newcomers in learning at their own pace, enabling them to enter the market with a sound understanding and improved confidence.

The UK market is embellished with potential, and the proper approach can yield significant returns. Constructing a diverse portfolio that consists of various asset types and continuous learning are paramount components for success. Investing may begin with uncertainty, but it comes with rewarding prospects for diligence and commitment.

—

Discovering how to invest is akin to learning a new language, and the process is just as rewarding. In the UK marketplace, where opportunities are vast, making informed choices is imperative. Here are crucial elements beginners should integrate into their investment journey for optimal results.

Formulating a Solid Plan

Begin by establishing a comprehensive financial plan. Knowing exactly what you want to achieve and having a timeline can significantly streamline decision-making. Embarking on investing without set goals often leads to zigzagging between choices, dissipating focus and missing out on potential returns.

Are Robo-Advisors the New Norm?

The advent of technology has simplified investing, with robo-advisors at the forefront. These platforms use algorithms to create and manage diversified portfolios tailored to your risk appetite and financial objectives. They are beginner-friendly, offering a hands-off investment experience that still yields results.

Alongside setting a robust plan and considering robo-advisors, keep in mind the significance of understanding fee structures in various platforms. The accessibility of investing in the UK is considerable, but fees can quickly accumulate and impact returns. Comparing platforms and their fee policies is prudent, ensuring gains aren’t unexpectedly diminished over time.

Investing can appear daunting, but by adopting a well-researched and systematic approach, success is within reach. Starting with small steps, consistently enhancing your knowledge, and confidently engaging with market tools can transform apprehension into empowerment. The UK landscape is inviting for beginners equipped with the right tools, providing a pathway to financial growth and independence.

Recommended Tips for Beginner Investors

The learning curve in the investing arena should never deter you from starting. With dedication and keen insight, your journey in investing as a beginner in the UK is more than viable – it’s promising.

By beginning your journey with the points mentioned above, you’re setting a firm foundation for a successful investment career.

—

I hope this structured guidance provides clarity and inspiration for your articles on “investing for beginners UK.” Let me know if there’s anything else I can assist you with!