Investing Guide For Beginners

Unlocking the Door to Investing: A Beginner’s Journey

Read More : The Fake Diversification: Why Holding 10 Stocks In The Same Sector Isn’t Safe!

Embarking on the journey of investing is much like setting sail for the first time; daunting yet exhilarating. Think of it as an adventurous treasure hunt where instead of hidden gold, you discover financial growth and stability. Our “Investing Guide for Beginners” is your map and compass, leading you towards making informed decisions in the vast sea of investment opportunities. When starting out, the initial steps can seem overwhelming, but rest assured, this guide simplifies the complexities, making investing accessible to everyone. A compelling mix of storytelling, humor, and practical advice creates an engaging and informative experience.

Imagine this: you’re sitting in a cozy coffee shop, sipping your favorite latte. Nearby, a group of friends chats excitedly about their recent stock picks. You catch snippets of their conversation—”bull market,” “portfolio diversification,” “compound interest.” It sounds like a foreign language, yet intriguing. You want in on this world where your money works for you, growing silently like a well-nurtured plant. Our investing guide for beginners promises to transform these mysterious terms into familiar friends, empowering you to enter discussions confidently and make your first investment with clarity.

Everyone remembers their first time—whether it’s the first day of school, the first job, or the first love. Investing is no different. The first decision to put your money at risk, hoping for a profitable return, is an emotional milestone. Combining rational analysis with emotional readiness, this guide provides a smooth transition from novice to knowledgeable investor. It is packed with actionable tips, testimonials from successful investors, and creative narratives to keep you engaged while learning. So, let’s jump into this exciting financial adventure, starting with the basics.

Understanding Your Investment Options

In the vast realm of investments, beginners often ask, “Where do I start?” It’s a fair question. Stocks, bonds, mutual funds, ETFs—the list seems endless and, let’s be frank, quite intimidating. But worry not; our investing guide for beginners is meticulously crafted to shed light on these avenues.

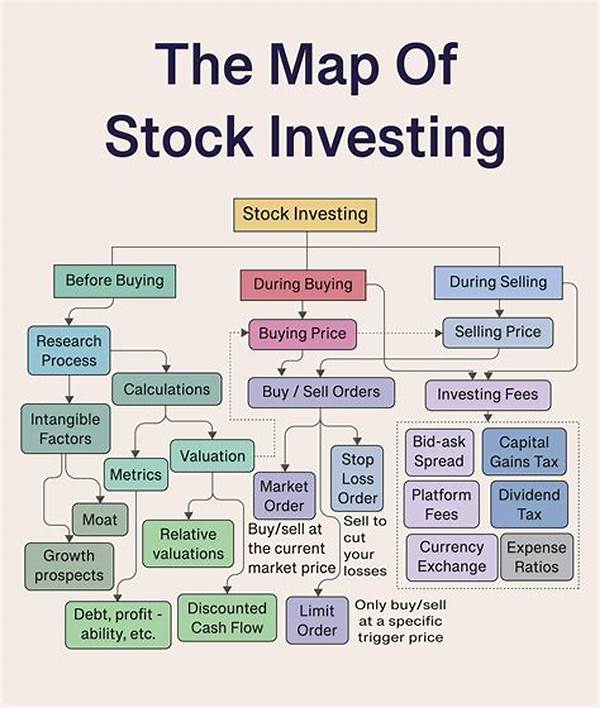

The Basics of Stock Market Investing

Venturing into the stock market is akin to reading a gripping novel filled with unpredictable twists and rewarding endings. Stocks represent ownership in a company, providing a slice of its success. Investing in stocks offers a dynamic opportunity to witness your money’s potential growth, but it’s essential to understand the rhythm of the market, driven by economic factors, industry trends, and human emotions.

Each of these elements influences stock prices as much as gossip influences Hollywood reputations. It’s like a grand play, and you’re both the audience and an actor with a stake in the outcome. Start by learning about key concepts such as indices, market volatility, and the crucial rule: diversify your investments to minimize risk.

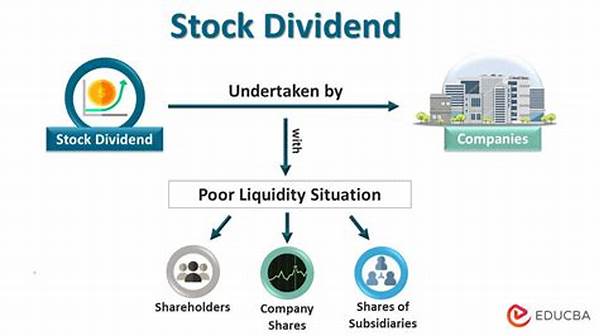

Finding an investment strategy that suits you is a call to action—a motivational push to achieve your financial dreams. For instance, meeting John, an amicable dentist turned investor, who initially hesitated but now delights in selecting dividend stocks. His story highlights one of the many paths you might consider as a budding investor.

A Diversified Portfolio: Your Safety Net

Analyzing investment choices narrows down the quest but emphasizes the importance of diversification. Like a well-balanced diet, a diversified portfolio offers a variety of investment types to stabilize your finances, insulating against potential downfalls in a single sector.

Why Diversification Matters

Imagine building a Jenga tower. Each block supports the structure; if one slips, the others hold it aloft. Diversification works similarly by spreading possible risks across multiple investments, ensuring that a downfall in a particular asset doesn’t topple your entire investment portfolio. Pursuing various channels, like stocks, bonds, and real estate, creates this robust financial foundation.

Research supports diversification as a time-tested strategy that maximizes returns while minimizing risks. As beginners, reading investment reports and analyzing market behavior can provide insights into creating a resilient portfolio. Embrace the learning curve; consider it an adventurous hike with each step bringing you closer to financial success.

Steps to Start Investing Wisely

Our investing guide for beginners is your trusty sidekick in navigating the financial landscape. Each small step towards knowledge builds confidence, propelling you towards investing success. Remember, the key is to start small, think big, and, most importantly, enjoy the journey.

—

Starting the investment journey is akin to writing the first chapter of your financial story. With this investing guide for beginners, you’re empowered to write a narrative full of growth, learning, and achievements. The key takeaway is the importance of understanding your options, strategic diversification, and consistent learning and adaptation. The world of investing awaits; all you need to do is take that first step.

How Emotions Affect Investing

The human element significantly impacts investment decisions. This component—the emotional rollercoaster of gains and losses—shapes how we approach investments. Anxiety during market lows and euphoria at highs often drive hasty decisions. However, discipline and rationality must govern our actions to ensure consistent progress toward financial goals. Learning to manage these emotions is a core lesson in our investing guide for beginners.

Your story, your adventure, your decisions—all shape your financial future. With knowledge and persistence, the investing world becomes a field of endless opportunities available to explore. Let this guide be the compass directing you to your financial victories.