Long Term Investing For Beginners

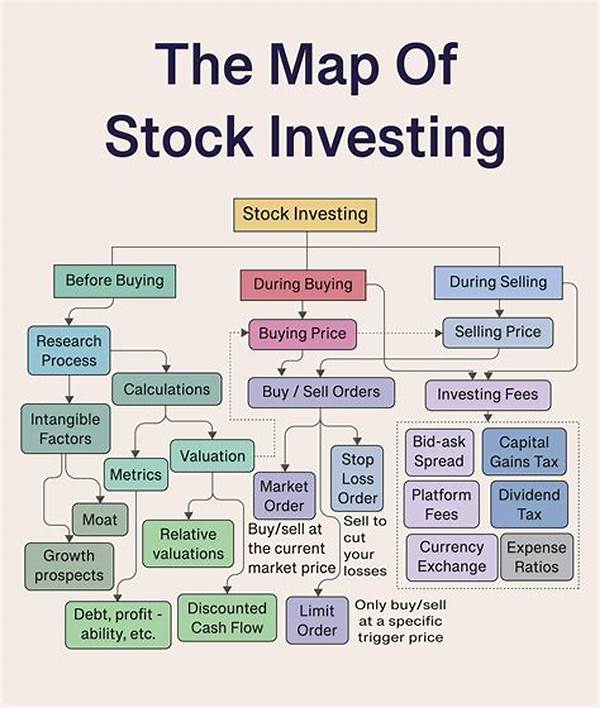

In the world of finance, where headlines flash with market crashes, stock surges, and economic forecasts, the concept of investing often feels intimidating. Especially for beginners, the swirling sea of information might seem overwhelming. However, there’s one strategy that stands the test of time—long term investing. Perfect for novices, this approach offers a lifeline in a sometimes turbulent ocean of financial uncertainty. But what is long term investing for beginners, and why is everyone raving about it?

Read More : Stock Market Investing For Beginners

Imagine planting a seed, nurturing it over the years, and watching it grow into a robust oak tree. Long term investing works in a similar fashion. It involves committing your resources to investments that, although they may take years to mature, promise substantial returns. You don’t need a crystal ball to predict the next big stock surge; instead, you rely on time, patience, and the resilience of the market. The journey isn’t just about going through financial reports or understanding complex charts; it’s also about embracing a unique financial philosophy that promotes growth and sustainability.

Why Long Term Investing is Your Best Bet

Shifting from the theory to action can feel like a giant leap. For those new to the game, remember the story of a tortoise and a hare. Slow and steady wins the race, and that’s essentially the ethos of long term investing for beginners. Think of it as less of a sprint and more of a marathon. To many, it may sound mundane, or even banal. However, research consistently shows that markets generally trend upwards over long periods, making long term investments not only a stable option but also a lucrative one.

The latent power of compounding is one of the hikers on this investment trail. By reinvesting your earnings, the interest-on-interest effect can exponentially enhance your original investment. The beauty of long term investing for beginners lies in its simplicity and effectiveness. You don’t have to be a Wall Street wizard or own a golden ticket; all you need is commitment and a plan. Whether you’re investing in stocks, real estate, or retirement funds, the long term outlook reduces the anxiety of everyday market fluctuations and leverages the positive historical market trends.

Investing might seem like a puzzle. It’s composed of strategies, financial jargon, and numbers that often don’t make sense to a novice. But what if you could unlock the secrets without an economics degree? The principles of long term investing for beginners are straightforward and accessible to everyone, not just the elite or financial gurus.

Long term investing is akin to planting perennials in your garden. You start with foundational principles: understanding your financial goals, assessing risk tolerance, and establishing a solid strategy. Imagine a blueprint—ensuring you’re not building a chaotic financial fortress but a reliable refuge for the future. This journey involves analyzing which asset classes align with your investment horizon and financial aspirations.

Strategies for Imaging Potential Growth

1. Educate Yourself: Knowledge is power, and learning about investment vehicles, market behavior, and economic trends is crucial.

2. Diversify Wisely: Don’t put all your eggs in one basket. Spread your investments across various asset classes to mitigate risks.

3. Consistency is Key: Regular contributions, no matter how small, make a significant impact over time.

4. Patience Pays Off: Markets fluctuate, but historical data suggests that they generally rise over time.

5. Monitor Your Portfolio: Regularly review and adjust your investments to align with your goals.

Navigating long term investing for beginners can feel like stumbling in the dark. But by following these principles, the path becomes clearer. Remember, it’s not merely about keeping your money under the mattress or spending it all; it’s about creating wealth for future generations and financial independence for yourself.

Overcoming the Fear of Investing

Fear often paralyzes potential investors. The sheer thought of watching their hard-earned money ebb and flow in the marketplace can be daunting. Yet, the real risk lurks in not investing at all. Long term investing for beginners eases this trepidation by fostering a mindset that focuses on consistent and gradual growth rather than quick, uncertain gains.

Engage with a community, whether it be a local investment club or an online forum. Share tips, seek advice, and learn from others’ experiences. Investing doesn’t have to be a solitary conundrum. Capturing the stories of seasoned investors, their triumphs, trials, and sometimes humorous financial faux pas, adds a human aspect to an otherwise impersonal field.

Testimonials of Long Term Success

Meeting with successful investors provides anecdotal assurance to beginners. Imagine sitting with a retiree who started investing in their twenties. They recount tales of economic downturns, booms, and innovations that shaped their portfolio. They remind you of the tortoise, slowly but assuredly crossing the finish line. It’s not just a success story—it’s a roadmap, telling you that long term investing isn’t merely a strategy; it’s a way of thinking deeply ingrained in the annals of investor success.

Conclusion

The road to financial stability might feel daunting, but with long term investing for beginners, it becomes an achievable journey. Remember, every big oak tree began as a tiny acorn. So, whether you’re sipping a latte contemplating significant market movements or discussing with a friend about stock options, envision your financial future like that oak tree—resilient, growing, and standing tall amidst the forest of market fluctuations. Take action today, embrace the wisdom of patience, and invest in not just your future but in peace of mind and prosperity.

Making the First Move in Long Term Investing

Investors often wrestle with fear, paralyzed by thoughts of fluctuating markets and unforeseen losses. Yet, the real risk is in sitting idly, letting financial opportunities slip by. Long term investing for beginners not only prepares one for market volatility but also instills a mindset focused on long-term prosperity rather than quick, unpredictable gains.