Short Term Investing For Beginners

H1: Short Term Investing for Beginners

Read More : Why Index Funds Still Win For Beginners

Are you ready to dip your toes into the electrifying world of investing but keep hearing intimidating terms like “bull market,” “bear market,” or worse, “recession”? No need to stress! Welcome to the vibrant universe of short term investing for beginners. Consider this your express ticket to a savvy financial life without the need to scale the Everest of long-term planning. Short term investing is like getting a backstage pass to quick returns, and who doesn’t like quick wins?

Let’s talk ambition first. Imagine you’re at a carnival. Long-term investing is the slow ride on a Ferris wheel, whereas short term investing is the exhilarating spin of the tilt-a-whirl. It’s thrilling, immediate, and leaves you eager for the next round. This approach is perfectly suited for enthusiasts eager to see their money grow in the short space of 1 to 5 years. So, why should beginners like you consider short-term investing as a financial playground?

The allure of short term investing lies in its pulse-quickening nature and potential for quick profits. Think about it like prepping for a short vacation. You plan for your packing essentials, track your budget, and squeeze excitement into a weekend. Similarly, short term investing lets you manage resources effectively and see faster results. Diversifying your portfolio isn’t just an expert-level move; it can be thrilling, like exploring a new cocktail menu. With options like stocks, treasury securities, certificates of deposit, or ETFs, the financial world is your oyster.

Statistics show that prudent short-term strategies can yield nice pay-offs without necessitating sleepless nights. According to a study by Investor Chronicle, markets that appear volatile at first glance often settle into profitable territory when carefully monitored. Hence, by the time you’re done with this read, you might just find yourself more charged than ever to start this adventure.

H2: Embracing Volatility in Short Term Investing

Now that we have your attention, let’s delve a bit deeper into the nuances of short term investing for beginners. Remember that short term investing is a lot like life. It’s unpredictable, exciting, and requires a bit of courage mixed with caution. The markets fluctuate, and prices soar and dip faster than the latest TikTok trend. However, for those equipped with knowledge and strategy, volatility transforms from a looming threat to a thrilling roller-coaster.

Speaking of strategy, tapping into resources like investment apps or partnering with a financial advisor can be game-changers for newcomers. Imagine getting expert insights while sipping on your morning coffee, without breaking a sweat. Plus, these platforms often gamify the experience, making it almost as engaging as playing virtual Monopoly.

So, how do you start this fascinating journey? Simple. Kick off with as little as you can afford to lose and diversify as much as possible. Your strategy should resemble a seasoned traveler’s itinerary—packed with experiences yet flexible enough to accommodate a surprise rainstorm. And don’t forget the backup plan. A poor investment choice shouldn’t wipe you out. Having an emergency fund is akin to carrying an extra umbrella—you never know when you might need it.

In the end, short term investing for beginners is not just about multiplying money; it’s about mastering the art of making your money work for you. Remember, every seasoned investor began as a beginner. By leveraging tools, knowledge, and a pinch of daring, you’ll soon be ready to replace ‘beginner’ with ‘pro’ in your financial lexicon.

—

Enhanced Structure for Short Term Investing

H2: Why Short Term Investing Matters

Short term investing is a ticket to financial assertiveness. Unlike long-term ventures that require prolonged foresight, short term investing for beginners demands a keen eye on current trends and the agility to pivot strategies with market changes. Essentially, it’s finance through augmented reality—concrete yet flexible enough to adapt to changes in the market landscape.

Short term investments typically last anywhere from a few months to a few years, making them suited for individuals hungry for rapid returns. Economists suggest this approach benefits those who are goal-oriented. Maybe you’re building a college fund or simply saving up for a dream vacation. Imagine achieving these milestones without needing a decade to realize them.

H3: Strategies for Short Term Investment

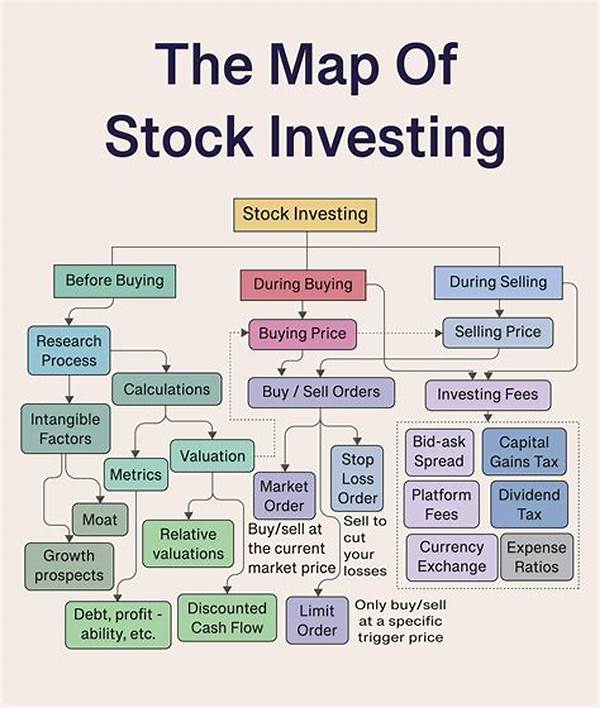

Now, when setting sail on this voyage, you better start with a sterling strategy. Establishing clear goals is crucial—they serve as your North Star. What milestones do you wish to reach in 1 year? 3 years? Once your objectives are set, the investment options available range from certificates of deposit to low-duration bond funds.

A crucial aspect of short term investing for beginners is risk assessment. Picture yourself at a crossroads. A high-yield option may tempt you down one path, while a conservative approach whispers safety. Sometimes, blending these options, like mixing flavors in your favorite brunch mimosa, creates that balanced sweet spot.

The Short Term Investment Toolkit

In today’s digital age, there’s a plethora of apps that provide real-time updates and analytics, each one a personal advisor at your fingertips. Imagine these applications like a friendly concierge, guiding you through the bustling market with real-time notifications and insights without missing a beat.

With an ever-evolving market, staying informed is vital. Tune in to financial news, read analyses, or join community forums where experiences and successes are shared. Much like following travel blogs before planning a getaway, these resources can offer invaluable tips for those dipping their toes into the investment waters.

Assessing the Risks and Rewards

Approaching short term investing with an educated outlook minimizes risks and amplifies rewards. Recall the tale of the tortoise and the hare? In the world of short-term investments, agility inspires the tortoise to run faster, blending endurance with quick adaptability—think rabbits sprinting across finish lines.

So gear up to meet your finances with clear objectives, the right tools, and a dash of boldness. Remember, short term investing for beginners isn’t just a journey; it’s a transformation. With a strategic approach, you’re not just saving for a rainy day; you’re investing in a future where the sun always shines.

—

Rangkuman tentang Short Term Investing for Beginners

In essence, short term investing for beginners offers a captivating entry point to finance, making it manageable yet exciting for anyone eager to learn and grow.

—

Insights and Advice on Short Term Investing

H2: Cultivating Financial Awareness in Short Term Investing

One of the most liberating aspects of short term investing for beginners is developing financial awareness. Just like learning to ride a bike, taking up short-term investments fine-tunes your sense of direction, balance, and even tumble safely if need be. Transforming from a spectator in the financial world to a participant is empowering, offering the keys to control over your money and destiny.

Financial literacy is akin to learning a new language—you start with the basics like saying ‘hello’ or ‘thank you’, soon escalating to deeper dialogues. As you familiarize yourself with terminology and strategic movement, you’ll find navigating stocks, mutual funds, or bonds becomes less intimidating. Remember, every investment teaches you a lesson, and staying updated with market trends can turn you into a savvy investor sooner than you think.

H3: Tools and Tips for Budding Investors

Starting with certain investment tools is crucial, akin to equipping an artist with brushes and a palette. Financial apps, investment books, and even committing to short online workshops can establish a robust foundational knowledge. By adopting technology, you get a competitive edge—real-time alerts and analytical insights are yours to command.

Forget the traditional notion that investing is a rich man’s game. Committing financially isn’t always about huge investments. Micro-investing apps, for instance, allow you to step into the investment world with spare change as a budget-friendly solution. Think about each small effort as planting a seed, with the right care, those investments can blossom tremendously.

—

Tips for Effective Short Term Investing

H2: Top 10 Tips for Beginners

Starting with short term investing can be smooth sailing with the right guidance. Here are 10 indispensable tips to get going:

Investing might seem daunting, but these tips can keep you on track for successful short-term investing for beginners, opening up a world of financial potential and growth.

—

By understanding these aspects, you can confidently step into the world of short-term investing, allowing you to secure your immediate financial objectives while riding high on this exhilarating educational journey. Remember, it’s the tiny steps that make up the longest journeys, turning beginners into experts.