Step-by-step Guide To Buying Your First Stock

Creating a comprehensive guide on buying your first stock is a great way to enter the financial world. This guide is designed to be your ultimate companion as you navigate the sometimes intimidating landscape of stock investment. Our goal is to transform the seemingly complex process into a simple and actionable plan. Here, you’ll find not just a step-by-step guide to buying your first stock, but also insights and tips that bridge knowledge gaps, ensuring you’re armed with the confidence to make informed decisions. The financial market offers a treasure trove of opportunities, but understand it’s not always a walk in the park. It’s akin to setting out on a new adventure—a financial roller coaster that, with the right gear and guidance, can be exhilarating and rewarding. So buckle up, and let’s demystify this journey with clever storytelling and keen insights mixed with a touch of humor.

Read More : Best Investing Platforms For Beginners Uk

H1: Step-by-Step Guide to Buying Your First Stock

Starting your investment journey might seem daunting, but with a clear roadmap, it becomes an achievable goal. The first step involves understanding your financial position. Do a detailed financial assessment and determine how much you’re willing to invest. We call this the ‘snack money strategy’ – using funds that won’t leave you gobbling Ramen noodles every night. Once you’ve identified your investment pot, decide the kind of investor you want to be. Are you a risk-taker or cautious like a cat near water? This choice will guide your stock picks.

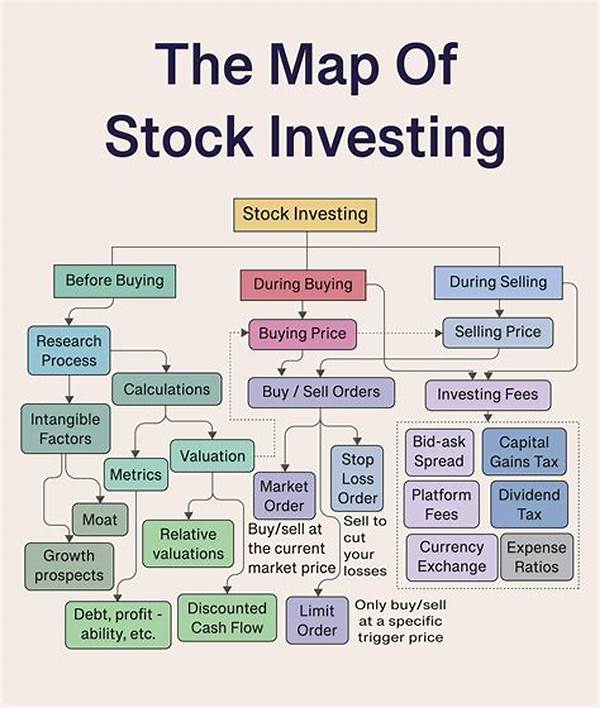

Next, it’s time to open your investment account. This is like the golden key to the financial wonderland. You can choose between different platforms, stocks, ETFs, or mutual funds, depending on your comfort level and investment goals. Here, conducting research is crucial. YouTube, financial blogs, and expert advice become invaluable allies. Try not to get overwhelmed by the stock jargon; remember, even seasoned investors were once amateurs.

After you’ve selected where and how you’ll invest, it’s action time. Execute your trades based on your research. Monitor the market trends and your stocks’ performance. This step should involve a blend of patience and vigilance. Don’t panic during market dips; remember, it’s all part of the stock market’s charm. It’s like dining on spicy food; sometimes it gets intense, but it balances out eventually.

Finally, after making your first purchase, regularly review and adjust your portfolio. Stay informed about the economic indicators affecting your stocks. Diversification should be your mantra; don’t put all your Easter eggs in one basket. Diversifying is like having multiple Wi-Fi options; if one fails, you still stay connected. This continuous process of learning and adapting will enhance your investor acumen. So remember, this step-by-step guide to buying your first stock is merely the start of your investing expedition.

H2: Essential Considerations in Your First Stock Purchase

Always remember to keep emotions in check. Investments, like relationships, require level-headedness, or they get messy. It’s crucial to strike a balance between your expectations and market realities. Consult experienced investors, but trust your instincts and analyses too. Your financial journey will have ups and downs, but with perseverance, the outcomes can be rewarding.

—

Structure

Not only is this guide the key to understanding the core steps needed in this investing journey, but it also provides an insight into the emotional and rational aspects of investing. From Jair’s testimonial on how she doubled her savings in six months to insights from a financial market walk-in-the-park, every piece of information gathered here is to uplift your financial IQ. Our narrative weaves through statistics and personal stories alike.

H2: Starting Off Right: Choosing the Right Brokerage

Choosing the right brokerage is crucial. Think of it like choosing a coach for your financial marathon. You need a platform that offers you the tools to succeed and back you up when the going gets tough. Seek out brokerages with zero fees, reliable customer service, and easy-to-navigate systems. They should also offer educational resources; never underestimate the power of knowledge. Remember, this is your first step in the step-by-step guide to buying your first stock.

H3: Researching Stocks: Instilling Confidence

When delving into the stock market, research acts as your guiding light. Dive into company reports, scrutinize trends, and absorb knowledge from market analysts. Numbers tell stories; interpret them wisely. As you research, your confidence in making the first purchase will solidify, transforming shaky legs into giants’ strides. In this story of buying your first stock, research becomes your trustworthy sidekick.

—

Your investment narrative should always revolve around learning and adapting. The financial realm, unlike any static book, constantly evolves. From market crashes to unicorn startups, the cycle of fall and rise is a constant. Enter with a mindset of curiosity, remain adaptable, and your investment story could become the next big testimonial for new investors. Embrace this step-by-step guide to buying your first stock as your anchor through the waves of the financial sea.

—

Key Points to Remember

—

In conclusion, the stock market is not just a numbers game; it’s a narrative of businesses, consumers, and the economy. When you decide on taking this step, you’re not just buying stocks; you’re buying into stories and potential. Never miss the significance of this step-by-step guide to buying your first stock. Embark on your financial journey with curiosity, caution, and courage. Your proactive approach today will determine the dividends of tomorrow.

—

Now, let’s encapsulate nine key takeaways from our step-by-step guide to buying your first stock in bite-sized, actionable insights:

H2: Actionable Insights for First-Time Investors

This comprehensive guide aims to make the financial investment landscape less intimidating and more approachable, using humor, stories, and research-driven insights to illuminate your path. Remember, even Warren Buffet took his first step, and today, you are taking yours. Never underestimate the power of this guide as you embark on your financial adventures.