Stock Market Investing 101 For Beginners

- Understanding the Basics: Why Invest in the Stock Market?

- Why Beginners Should Care About the Stock Market

- The Power of Diversification

- Making Educated Decisions with Research

- Emotional Discipline in Stock Market Trading

- How Technology is Changing Investing

- Final Thoughts on Starting Your Investment Journey

- How to Choose Your First Stocks

Stock Market Investing 101 for Beginners

Read More : Long Term Investing For Beginners

Embarking on the journey of investing in the stock market can feel like venturing into a new city without a map. Where do you start? What landmarks should you look for? But worry not, it’s not as overwhelming as it seems. This article, “Stock Market Investing 101 for Beginners,” is your guide to navigating this financial avenue. Think of it as a travel guide, but instead of visiting historic sites, you’re exploring companies and stocks. Whether you’re dreaming of being the next Warren Buffet or simply want to manage your money wisely, understanding the basics is crucial.

The stock market is essentially a platform where investors buy and sell shares of publicly-listed companies. Imagine participating in the growth story of the next big tech company or the revival of a traditional manufacturing firm by owning a tiny piece of it. Yet, the thought strikes, “Is it risky?” Yes, but so is crossing the street. With stock market investing, the key is vigilance and research. It’s about understanding businesses, the economy, and sometimes just going with your gut. With every investment, there’s a risk of losing money, but with great risk comes the potential for great reward. By starting with a foundational understanding provided in “Stock Market Investing 101 for Beginners,” beginners can reduce those risks through informed decisions.

Every experienced investor started as a beginner and learned from their mistakes. Consider stock market investing as a learning curve, with each dip and rise adding to your knowledge reservoir. It’s exciting, like watching a thriller; you anticipate the climax and sit on the edge of your seat. Whether you’re investing for retirement, education, or a new car, the stock market opens doors to endless possibilities. Now that we’ve captured your interest, let’s dive deeper into how this all works.

Understanding the Basics: Why Invest in the Stock Market?

Investing in the stock market offers an opportunity to grow your wealth in ways that savings accounts simply can’t match. It’s about putting your money to work to earn more money. When combined with the power of compounding, stock market investments have the potential to build substantial wealth over time. But how do you get started? How do you read the stocks, and what influences their ups and downs? For beginners, understanding the stock market might feel like learning a new language. There’s bulls, bears, dividends, and more. Fear not, as this “Stock Market Investing 101 for Beginners” covers all these aspects and turns the daunting into the doable.

———-Discussion: Stock Market Basics and Strategies

Why Beginners Should Care About the Stock Market

So, you’ve heard people talking about the stock market, but why should you care? The stock market is not just for Wall Street professionals. It’s a tool for building personal wealth. By investing, you engage in a proactive form of personal finance management. With the right strategy, stock market investing can help you achieve financial goals that are far bigger than you’d imagine through mere savings. Remember, “Stock Market Investing 101 for Beginners” is your first step into this exhilarating world.

The Power of Diversification

Diversification is the financial equivalent of not putting all your money in one wallet. Imagine investing in just one stock and watching it plummet. That would feel like betting all your chips on red with high stakes – risky and nerve-wracking. “Stock Market Investing 101 for Beginners” highlights the importance of diversification by spreading your investments across various stocks and sectors, which minimizes the risk and increases the potential for returns. Think of it as packing both sunscreen and a raincoat for a trip; you’re prepared no matter the weather.

What if you prefer not to pick individual stocks? There’s an alternative! Index funds or ETFs are great ways to diversify without the hassle. They track a market index and spread your investment across many stocks. It’s like getting a sampler platter at a restaurant—you get a taste of everything without committing to just one dish.

Making Educated Decisions with Research

Being well-informed is crucial for success in the stock market. With easy access to a plethora of resources, beginners today can learn about investing with a simple click, swipe, or search. Start by understanding the company whose stock you’re interested in. What do they do? What are their future prospects?

As stipulated in “Stock Market Investing 101 for Beginners,” it’s not about predicting the future, but rather, reading the present correctly. By keeping up with economic news, quarterly earnings, and company developments, you make better-informed decisions, which is the bedrock of successful stock investing.

Emotional Discipline in Stock Market Trading

Stock market investing can be emotional. Watching your investment’s value swing can cause anxiety or false euphoria. It’s crucial to maintain emotional discipline and make rational decisions. Remember, in stock market investing 101 for beginners, patience often pays off. Short-term market fluctuations are normal, but it’s important to stay focused on your long-term goals.

However, it’s also perfectly normal to seek help. Financial advisors or investment services can guide you through stormy waters. By doing so, you leverage their experience to make the most of your investments. It’s like hiring a guide for your first mountain climb instead of venturing out solo.

How Technology is Changing Investing

Technology has revolutionized stock market investing. Online platforms and apps now make it easy for everyone to start their investment journey. Stock market tools provide real-time data, analyses, and even predictions. “Stock Market Investing 101 for Beginners” emphasizes leveraging these technologies, which can simplify and enhance your investing experience.

Final Thoughts on Starting Your Investment Journey

Starting with stock market investing might seem daunting, but the key is taking that first leap of faith. Your journey begins with a single step—or perhaps a single stock! The landscape of investment is vast and beautiful, and with patience and diligence, it offers boundless opportunities for wealth creation. So, what are you waiting for? Dive into “Stock Market Investing 101 for Beginners” now and let your money start working for you.

———-Examples of Stock Market Investing 101 for Beginners

———-

How to Choose Your First Stocks

Strategic Investment Decisions

The world of stocks can be mesmerizing yet overwhelming, especially for those just sticking their toes into this new venture. “Stock Market Investing 101 for Beginners” serves as a compass amid this financial wilderness. Picking your first stocks should not feel like you’re blindfolded throwing darts at a board of companies. Instead, it should involve strategic decisions backed by personal interests and diligent research.

Engage in understanding what excites you, whether it’s technology, consumer goods, or maybe sustainable energy. Align your investments with these interests, as they might help mitigate the daunting learning curve – after all, you’re more likely to stay informed about subjects that capture your passion.

For instance, interested in the next tech breakthrough? Look for firms leading in AI or green technologies. Eager about healthcare innovations? Consider firms pioneering new medical treatments. The key is ensuring you match ambition with knowledge. Stock market investing 101 for beginners isn’t about high risks but smart risks.

Additionally, initiating investments with familiar brands can reduce reluctance and foster learning. Whether it’s a coffee company you love or a tech firm whose products you use daily, having a personal connection does wonders for investment confidence.

Evaluating Company Prospects

Investing shouldn’t be a gamble, even though Lady Luck sometimes plays her cards. To counter the uncertainties, evaluate company prospects. Investigation into company health involves tracking their financial statements. Numbers on balance sheets, income, and profitability ratios speak volumes about a company’s health. Search for steadily increasing revenues and strong profit margins; these indicators suggest a company’s growth trajectory.

Engage with stock market analyses and predictions, but maintain a healthy skepticism. Even seasoned market analysts don’t have a crystal ball, as the stock market’s unpredictability is a thing of beauty and bewilderment. Rely on data more than hearsay.

Interpreting data becomes easier with practice, starting from “Stock Market Investing 101 for Beginners.” Learn to decipher a company’s competitive edge – its secret sauce, so to speak. This secret might be innovative technology, patents, or leadership that can steer a company towards future success.

Conclusion

Aspiring investors, the world of stocks is as vast and colorful as the many hues in a rainbow. The journey might be challenging, but when approached as advised in “Stock Market Investing 101 for Beginners,” it becomes less intimidating and more exhilarating. By learning continuously, investing strategically, and methodically assessing stocks, the stock market can become a treasure trove of opportunities. Begin your pursuit today, let the figures unfold stories of growth, and witness your financial dreams turn into achievable reality!

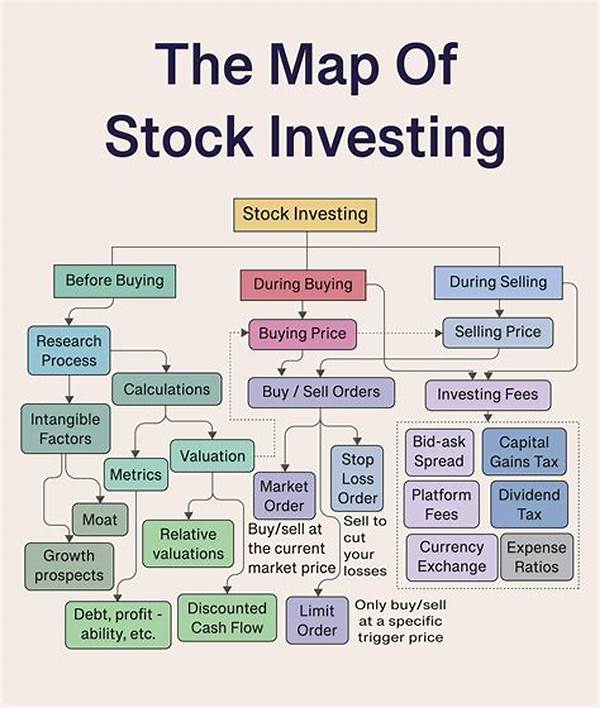

———-Understanding Key Concepts in Stock Market Investing

Risk management is crucial when investing. Tools like stop-loss orders can help prevent significant losses.

Compounding works wonders over time as you earn returns not just on your initial investment but also on the accumulated interest over time.

National and global economic conditions affect the stock market, making it essential to stay informed about current events and trends.

Examples include the S&P 500 or Dow Jones. These provide snapshots of overall market performance.

Long-term investment or day trading? Develop a strategy fit for your risk tolerance and financial goals.

Understand the tax implications of your investments to efficiently manage and maximize returns.

Detangling the Stock Market Web

In navigating the financial terrain, a deep understanding of the key concepts in stock market investing becomes vital. Think of it as assembling a puzzle: understanding each piece aids in constructing the complete picture. Start exploring risk management—the quintessential shield for your investments. Balancing risk and reward through diversification and risk assessment are tools in an investor’s toolkit. They provide defense against market volatility and safeguard your financial future.

By embracing the principle of compound interest, it’s clear why seasoned investors advocate patience. Over time, compounding enables investments to grow exponentially, turning modest sums into significant wealth. This is a fundamental aspect of “Stock Market Investing 101 for Beginners.”

Every investment decision involves economic factors influencing market trends and stock prices. Stay ahead of the market by following global developments and leveraging technology to access real-time data. This proactive approach transforms stock market investing from a game of chance into a well-informed financial strategy.

Allocating your investment across different sectors decreases risk exposure. Meanwhile, understanding tax implications of investments ensures that maximum profits remain intact. With the vast expanse of information available, “Stock Market Investing 101 for Beginners” empowers you to navigate this intricate web, not as a novice, but a budding expert ready to seize financial opportunities.