Why Dollar-cost Averaging Always Works

At some point in our lives, we all embark on the quest for the perfect investment strategy—one that’s profitable, reliable, and downright bulletproof. The financial world has hurled numerous methods and formulas at us, each promising bountiful returns and stress-free futures. Yet, amidst this whirlwind of options, one technique stands out like a lighthouse on a foggy night—dollar-cost averaging (DCA). What makes this strategy so appealing, you ask? Well, aside from its easy-to-grasp mechanics, DCA invites you to invest your money regularly, regardless of market conditions, leading to potential gains over time. It’s like sowing seeds in a garden; water them periodically, and watch your financial flora flourish with time.

Read More : Stock Market Trends Beginners Should Watch

The Magic of DCA Explained

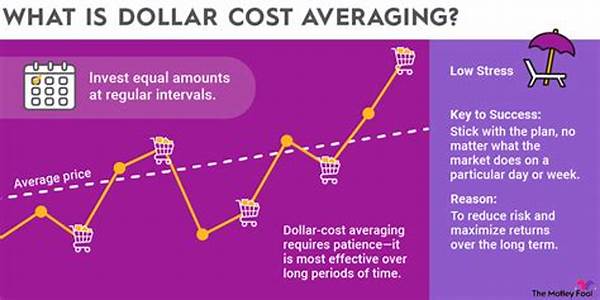

Imagine investing in slices of stock like grabbing a slice of your favorite pizza each week, regardless of its current topping price. By adhering to a routine of consistent investment, you avoid the roller-coaster emotions tied to market timing. When prices soar, your contribution buys fewer shares, and conversely, when prices dip, your money secures more shares. It’s akin to the tale of the tortoise and the hare, where slow and steady wins the race. This can be particularly beneficial if your monthly budget doesn’t allow for huge lump sum investments. Why dollar-cost averaging always works can often be seen in investors who have played the long game, reaping the advantages of stock price fluctuations over decades.

—

To those unfamiliar with the investment landscape, smelling the aroma of dollar-cost averaging might remind them of freshly brewed coffee—a simple pleasure with many hidden complexities. Beyond its simplicity lies a strategic brilliance that minimizes the impact of market volatility, offering a shield against the boisterous tides of emotional investing. Let’s dive deeper, indulging in why dollar-cost averaging always works, piece by piece.

What Makes DCA Foolproof?

In layman’s terms, DCA is the designated driver in the chaotic road trip of stock market adventures. It doesn’t require investors to stay sober-eyed 24/7; instead, it allows them to partake in the market without worrying about its unpredictable hangovers. When employed over extended periods, the average cost per share potentially evens out, evening out the risk and moving the needle closer to reward. With DCA, you essentially buy during the highs and the lows, thus evening out the bumps of price volatility.

A Timeless Tale of Growth

Picture an investor named Joe. Flashback to the late 1980s when Joe decided to invest $100 monthly in an index fund. Fast forward to the present day, as Joe nestles in his comfy recliner, scrolling through his swollen portfolio with a mug of hot chocolate in hand. Why dollar-cost averaging always works is embodied in Joe’s journey—his portfolio ballooned not through sporadic market victories but through the constant application of DCA, allowing the fluctuating market to fatten his returns over time.

Building Wealth with Peace of Mind

With dollar-cost averaging, gone are the sleepless nights haunted by market swings. Instead, savor the sweet slumber that accompanies steady, calculated investments. It is the investment plan for the risk-averse, an antidote for the jittery souls wary of market whims. And here lies its unique beauty—simplicity converging with effectiveness. Why dollar-cost averaging always works for those seeking the dream of financial freedom wrapped in serenity.

—

Tags Related to Why Dollar-Cost Averaging Always Works

—

In an age where everyone seeks instant gratification, markets can feel like chaotic casinos. People chase that elusive jackpot, hoping to strike it rich through timely trades, all while ignoring a proven ally—dollar-cost averaging. Why dollar-cost averaging always works is because it stands opposed to gambling-minded market timing, embodying instead the principles of patience and prudence.

The Perils of Market Timing

Market timing often resembles a high-stakes poker game with vast fortunes on the line. Many have attempted to perfect this art, but few have succeeded without a few unfair cards played by Lady Luck. Imagine the anxiety and angst of missing out on a bullish surge or slipping down the rabbit hole during a bear market. Now, breathe a sigh of relief. Dollar-cost averaging is your oasis of calm, the wind beneath the wings of financial freedom.

A Level-Headed Approach

As puissant as it is poignant, this strategy offers tranquility that market timing cannot. It’s the zen garden amidst blaring sirens at Wall Street. When you adopt DCA, you’re not driven by compulsions to time your investments correctly. You’ll wonder why you didn’t pat yourself on the back sooner. The beauty lies in its consistent simplicity, freighted with historical underpinnings of safety nets woven over time.

—

In conclusion, dollar-cost averaging isn’t just a safety net for your investments; it’s an ally aiding your financial liberation. It’s like planting a money tree where growth requires only time and regular watering. Cross out those “what-ifs” and let dollar-cost averaging do the heavy lifting, embarking earnestly along the path to fulfilling financial prosperity.