Why Financial Advisors Recommend Etfs

Why Financial Advisors Recommend ETFs

Read More : Etf Investing Made Simple For First-timers

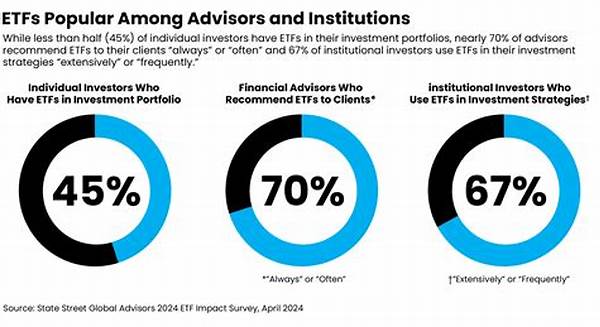

In today’s dynamic financial landscape, investors are constantly seeking strategies to optimize their portfolios and secure their financial futures. Enter Exchange Traded Funds (ETFs) – a versatile and frequently recommended tool by financial advisors worldwide. ETFs have revolutionized the investment game, offering a potent blend of diversification, flexibility, and cost-efficiency. Whether you’re a novice investor or a seasoned market player, understanding why financial advisors recommend ETFs can be your gateway to smarter investment decisions.

Financial advisors act as the architects of your financial future, designing strategies that align with your goals. They often suggest ETFs due to their ability to spread risk across a broad range of assets. By investing in ETFs, you can gain exposure to various market segments without the burden of picking individual stocks. This diversification minimizes risk, allowing investors to weather market volatility more effectively.

Moreover, ETFs are celebrated for their liquidity and transparency. Traded like stocks on major exchanges, they provide the ability to buy and sell throughout the day, ensuring flexibility in managing your investments. The transparency of holdings in well-managed ETFs keeps investors informed about what they own, an essential feature in building trust and confidence in an investment portfolio.

The Benefits of ETF Investing

In the grand chessboard of finance, ETFs have emerged as a preferred choice for many advisors due to their numerous advantages. Firstly, they often come with lower expense ratios compared to mutual funds, meaning more of your money is working for you rather than being eaten up by fees. This cost-effectiveness is a significant reason why financial advisors recommend ETFs, especially for long-term investment strategies where costs can compound over time.

Secondly, the ease of access and variety within the ETF market is unmatched. Whether you’re targeting a specific industry, commodity, or geographic region, there’s likely an ETF tailored to that focus. This flexibility allows investors to customize their exposure according to personal preferences or market insights. With the rising interest in thematic investments, ETFs provide a platform for tapping into emerging trends without a substantial upfront commitment.

Lastly, ETFs offer a tax-efficient investment vehicle. Unlike mutual funds, which can incur capital gains taxes within the fund, ETFs typically trade in-kind and therefore pass fewer taxable events to investors. This tax efficiency, combined with the other benefits, underscores why financial advisors recommend ETFs as part of a well-rounded investment strategy.

—Discussion: Why Financial Advisors Champion ETFs

In recent financial discourse, the merits of Exchange Traded Funds (ETFs) have often been highlighted by professionals advising on portfolio management. It’s no surprise then that one of the pressing questions in investment circles is why financial advisors recommend ETFs. Let’s delve into this topic, unraveling the factors that make ETFs a standout choice.

When exploring why financial advisors recommend ETFs, one must consider their inherent design that supports diversified investment. Unlike singular stock picks, ETFs encompass a range of securities, protecting the investor from the full brunt of volatility in case one sector or asset underperforms. This built-in diversification is crucial, especially during unpredictable economic times, ensuring that an investor’s financial health isn’t tied to the fortunes of a single investment.

Moreover, the cost-effectiveness of these instruments significantly influences why financial advisors recommend ETFs. Generally, ETFs have lower management fees compared to their mutual fund counterparts. This is because they are passively managed and merely track an index rather than actively selecting stocks. As fees play a crucial role in net investment returns, the lower expense ratios of ETFs mean more money compounds in the individual’s favor over time.

Flexibility and Accessibility

Another persuasive aspect that elucidates why financial advisors recommend ETFs is their trading flexibility. ETFs can be traded like stocks at any point during market hours, giving investors the agility to respond swiftly to market changes. This stands in stark contrast to mutual funds, which can only be bought or sold at the end of the trading day.

Additionally, the level of accessibility that ETFs provide makes them a cornerstone for building both modest and extensive portfolios. With the wide variety of ETFs available, investors can easily tap into different sectors, regions, and asset classes, curating a portfolio that aligns precisely with their financial aspirations and risk tolerance.

The Transparency Factor

Transparency is yet another compelling reason why financial advisors recommend ETFs. Unlike some investment vehicles that might hold opaque or complex underlying assets, ETFs maintain clear and consistent disclosure of their holdings. This transparency enables investors to know exactly what they own and aids in making informed decisions about potential buy or sell actions.

However, it’s not just about what financial advisors convey; it’s also about trusting the process. The credibility of financial institutions managing these ETFs boosts investor confidence. By knowing who manages their investments and comprehending how ETFs function, investors find themselves armed with knowledge and prepared for healthier financial decisions.

In conclusion, the enlightenment about why financial advisors recommend ETFs stems from their unique advantages – diversification, cost-effectiveness, trading flexibility, and transparency, all wrapped in a robust investment package. For those looking to optimize their portfolios, heeding the advice of financial advisors and considering ETFs could be the key to fruitful investment ventures.

—Actions: Why Financial Advisors Recommend ETFs

Understanding why financial advisors recommend ETFs can significantly enhance your investment strategy. Here are ten actions aligned with the reasons financial advisors favor these versatile instruments:

Why ETFs Are the Financial Advisor’s Tool of Choice

ETFs have revolutionized portfolio management, transforming the way financial advisors build and recommend investment strategies. The key allure of ETFs lies in their structural advantages, which not only make them attractive to investors but also a prudent choice for advisors aiming to deliver consistent, reliable results.

One of the primary reasons why financial advisors recommend ETFs is the sheer breadth of exposure they offer within a single investment. Unlike picking individual stocks, ETFs allow investors to capitalize on an entire market segment or index with one purchase, spreading risk and increasing potential rewards. This broad-based exposure aids in maintaining a balanced portfolio, often a central tenet of sound financial planning.

Another compelling feature is cost-effectiveness, a cornerstone of ETF appeal. By nature, ETFs typically have lower fees than traditional mutual funds due to their passive management style, which involves replicating an index rather than active trading. This cost advantage is pivotal, especially over the long term, as it enhances net returns by reducing the impact of fees on investment performance.

Navigating Market Volatility with ETFs

In times of financial uncertainty, the stability offered by ETFs is invaluable. Their structured approach to diversification provides a safety net against market swings, ensuring that any setbacks in one sector are potentially offset by gains in another. This aspect of risk mitigation is a persuasive reason why financial advisors recommend ETFs, particularly to clients seeking stable returns without the high volatility associated with single-stock investments.

Furthermore, the flexibility of ETFs cannot be understated. Traded on exchanges just like stocks, they offer real-time pricing and the ability to react promptly to market changes. This fluidity is a significant factor in managing dynamic investor needs and aligning with short-term market movements, an attribute that resonates well with both novice and seasoned investors.

For those pondering why financial advisors recommend ETFs, understanding these elements is crucial. It’s not merely about following a trend, but recognizing the inherent advantages that these instruments offer in crafting a robust financial future.

By integrating ETFs into your investment strategy, you’re not just diversifying your portfolio but also fortifying it against uncertainty, all while benefiting from a cost-effective, transparent, and flexible investment vehicle. The case for ETFs is compelling, and heeding the advice from financial experts can be the stepping stone to achieving long-term financial success.