Why Patience Is The Key To Investment Success

- The Art of Waiting: An Investor’s Secret Weapon

- The Long Haul: A Path Less Trodden

- Structure: The Blueprint of Investment Success

- Strategies for Consistent Growth

- Patience: A Story of Emotional Control

- A Narrative of Financial Patience

- Cultivate Patience for Lasting Success

- Timing the Markets: A Recipe for Success or Disaster?

- Practical Tips to Embrace Patience

In the world of investment, achieving success can often feel like catching lightning in a bottle. Why? Because it’s as much about navigating tides of market fluctuations as it is about knowing when to hold onto a potentially lucrative stock, and when to let it go. The crux of this understanding lies in one simple word: patience. Imagine you’re at a bustling carnival—thrills and chaos abound, much like the stock market. There’s excitement in every corner, vendors shouting their enticing offers, promising quick gains and instant profits. It’s tempting, but remember, the first rule of the game is to take a pause, breathe, and not get swept away by the glitter and gleam.

Read More : Book Investing For Beginners

Investing isn’t just about buying low and selling high; it’s about the strategy of patience. The long game, so to say. Consider it as planting a seed—nurturing it, watering it, and waiting, sometimes for years, to see the fruits of your labor. Through this lens, “why patience is the key to investment success” isn’t just a catchy headline; it’s a mantra that has proven itself time and again through historical data, seasoned investor testimonials, and even failed ventures where patience was lacking.

The Art of Waiting: An Investor’s Secret Weapon

To underscore the importance of why patience is the key to investment success, let me whisk you away to a little tale from 2008. There stood the mighty Apple Inc., seemingly taking its last breath, yet a few ardent believers clung onto their shares. Today, those who waited have seen their patience blossom exponentially, just like Jack and his magical beanstalk. Patience isn’t just a virtue in life; it’s a seasoned investor’s best tool, transforming perilous pitfalls into profitable peaks. Remember, each tick of the clock isn’t just passing time; it’s a potential turning point in your investment. The echoes of “buy and hold” ring true because fortune favors the patient, and compounding interest is the silent whisper guiding you toward wealth.

—

With everyone’s eyes glued to minute-to-minute market updates and news flashes predicting doom or glory, it’s easy to feel a pang of FOMO—fear of missing out. The pressure weighs in when everyone around seems to score the seemingly unattainable jackpot of instant riches. Herein lies the critical message of why patience is the key to investment success.

In the tapestry of financial stories, let’s pull on a thread about Warren Buffett. His anecdote about how the stock market serves as a device for transferring money from the impatient to the patient isn’t just clever wordplay; it’s grounded in an undeniable truth. The glitzy allure of quick gains quickly fades with the realization that lasting wealth is nurtured through meticulous planning, steadfast discipline, and yes, patience.

The Long Haul: A Path Less Trodden

The patience required in investments aligns with a common theme in life—delayed gratification leads to significant rewards. The challenge, however, is not in understanding “why patience is the key to investment success,” but more so in executing it. People are often wired to chase immediate satisfaction, yet seasoned investors understand that real wealth accumulation takes time.

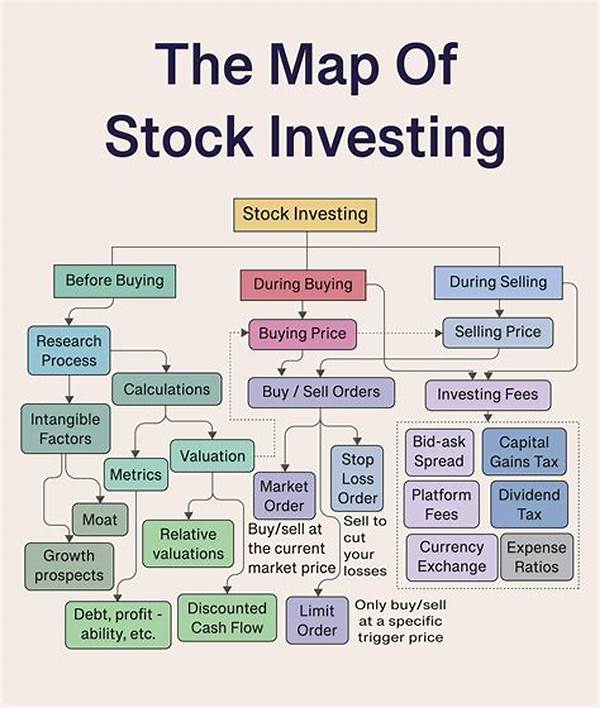

Strategies to Cultivate Patience

How do you cultivate patience in the rollercoaster realm of investing? One powerful technique is diversifying your portfolio; think of it as spreading your poker chips across various tables. Another is focusing on the process rather than the immediate results. Analysts have noted that those who adopt a long-term perspective often outperform those chasing every market trend. The emotional upheaval of short-term losses fades in the face of sustained gains witnessed over time.

Moreover, academic studies indicate that focusing on the ‘bigger picture’ shields investors from the volatility induced by daily market swings. Patience renovates the mind into perceiving temporary downturns as opportunities rather than failures. And while experts might point to graphs and market trends, it’s the patience to sit through rain for the rainbow that truly counts.

—

Structure: The Blueprint of Investment Success

Many consider the stock market synonymous with roller coasters, a ride where only thrill-seekers and the inherently lucky dare to tread. However, seasoned investors know this isn’t the case. Why patience is the key to investment success diverges from this narrative. It reveals the market as a meticulous chessboard where strategic patience resonates more powerfully than adrenaline-driven decisions.

The structure underlying this truth is multi-faceted and includes understanding both macroeconomic trends and personal financial health. Investors must educate themselves, setting realistic benchmarks and committing to ongoing learning, while practicing patience with each decision. As a result, the ride becomes less about the emotional highs and lows and more about a steady, calculated journey toward financial prosperity.

Strategies for Consistent Growth

Think of investing as crafting a fine wine. It requires patience, observation, and a knack for recognizing subtle changes over time. Market conditions shift, industries pivot, and economic factors fluctuate. Yet these very challenges underscore the importance of a well-anchored strategy seasoned with patience. Let’s explore how understanding why patience is the key to investment success becomes a game-changer, turning a seemingly unpredictable adventure into a guided expedition.

—

Fashion and investment? At first glance, these might seem worlds apart, yet they mirror each other in their cyclical nature. Trends come and go. Likewise, why patience is the key to investment success lies in recognizing and embracing these cyclical patterns rather than reacting impulsively to every market sneeze.

In an age of instant gratification, the virtue of patience seems misplaced, yet it’s more relevant than ever. As with trending fashion styles, investment returns can take seasons—years, even—to fully mature. The legendary investor, Peter Lynch, frequently emphasized the point that stocks akin to fashion trends need time to grow and mature fully.

Recognizing Real Opportunities

In this sea of opportunities, sorting the wheat from the chaff requires patience and discernment. Imagine owning stocks akin to the next ‘little black dress’; timeless and ever-appreciating, yet realized only by those who can wait for the collection to hit the runways. Investment often requires sitting through the fog of uncertainty before the bright sales begin to shine.

Patience: A Story of Emotional Control

A Harvard study pinpointed how emotionally driven decisions in investing can lead to unwanted outcomes. The anecdote of an investor who panics under stress and sells assets at rock-bottom prices only to witness their resurgence shortly afterward exemplifies why patience is the key to investment success.

Sawing off the emotional highs and lows that come with market fluctuations demands iron-willed patience. Investors who master this find themselves surfing the waves of market volatility, confidently waiting for optimal conditions to execute their moves rather than reacting from fear or greed. This calm in the storm becomes their compass in the unpredictable seas of investing.

The Power of Staying the Course

Investors often find success not in doing something different, but in sticking with sound investment principles through varying market cycles. Like achieving a cumulative masterpiece piece by piece, an investment portfolio, too, achieves its potential through the continuity afforded by patience.

By leveraging research, understanding market cycles, and maintaining a disciplined approach, investors can navigate the complexities of the market. Stories abound of individuals who lacked initial capital but found financial independence through consistent investments over decades. Each story consistently underscores why patience is the key to investment success. It’s not just about the immediate outcome, but the long-term journey and realization of your financial aspirations.

—

A Narrative of Financial Patience

Picture yourself standing on a serene pier; the waves gently lapping against the stilted legs supporting your vantage. It’s peaceful unless the skies decide to pour their fury. Now, convert this image to an investment landscape where market crises symbolize wrathful tempests. In both scenarios, patience forms the paddle that steers you through. Times of distress call for calm reflections as we embrace the inevitability of cycles rather than succumb to their fickle whims.

Investments demand a long-term lens. This isn’t about avoiding risk but about planning for longevity. Patience isn’t passive; it’s a strategic act on its own, supporting informed adjustments and consistent strategies towards wealth creation. Thus, recognizing the long-term victories aligned with patience becomes imperative for those seeking not just success, but sustained financial resilience.

Cultivate Patience for Lasting Success

The end game, just like with any meaningful aspiration, is never solely about reaching the destination; it’s about reveling in the journey. Recognizing the ebb and flow of market patterns requires understanding and foresight. Successful investors are those who confidently ride both peaks and troughs with the foresight that patience will yield prosperous returns.

By embracing the insights and real-life instances within investment circles, one can appreciate why patience is the key to investment success. It welcomes a transformative journey quite unlike anything fleeting, cementing a narrative steeped in personal growth and financial stability.

—

Navigating an investment journey is much like crafting a fine wine; it’s a process requiring an intricate balance of expertise and waiting. Instant results are appealing, but for sustainable success, patience is paramount. Understanding why patience is the key to investment success involves recognizing that the market is designed to transfer wealth from the impatient to those who can bide their time.

Timing the Markets: A Recipe for Success or Disaster?

In today’s world, where immediate results often overshadow long-term gain, beginners may feel swayed by short-term market thrills. However, seasoned investors warn against trading too frequently based on fleeting news and prices, emphasizing the art of timing lies in patience, not impulsiveness.

The Role of Emotional Stability

Investments are marathons, not sprints. This means weathering both flourishing and faltering markets with grace. Emotional stability, fortified by patience, becomes a vital arsenal against the tides of uncertainty. It’s about staying the course through unavoidable downturns and celebrating the journey, not just the destination.

Practical Tips to Embrace Patience

When embarking on an investment journey, it helps to set clear long-term objectives. Diversifying investments, educating oneself continuously, and regularly reviewing progress become allies in nurturing patience. Contemplating success stories reminds investors why patience is the key to investment success; it’s an investment in time yielding exponential returns.

Focused Growth and Financial Health

This isn’t just financial advice; it’s life advice. Committing to a philosophy of patience enhances financial health and nurtures invaluable life skills, such as resilience and forward-thinking. The true measure of investment achievement isn’t how much you gain in times of prosperity, but how well you hold your ground when the going gets tough.

So, the next time you’re spurred to react impulsively to market noise, take a step back. Revisit the timeless counsel echoed by the investment greats: patience, above all, drives investment success. Embrace this mantra, and watch as the financial seeds sowed today evolve into plentiful harvests tomorrow.