The #1 Crypto Tax Mistake That Lands Young Investors In Hot Water With The Irs!

The #1 Crypto Tax Mistake That Lands Young Investors in Hot Water with the IRS!

Navigating the dynamic world of cryptocurrency can be an exhilarating experience, especially for young investors eager to ride the wave of digital finance. However, underlying this excitement, there is a critical consideration that is often overlooked: taxes. Yes, while delving into Bitcoin, Ethereum, and other digital assets can potentially lead to financial gains, it comes coupled with the responsibility of tax compliance. As the infamous words go, “The only certainties in life are death and taxes.” Ignorance or negligence around crypto taxes can quickly turn into the #1 crypto tax mistake that lands young investors in hot water with the IRS!

Read More : How Crypto Impacts Traditional Banking Explained

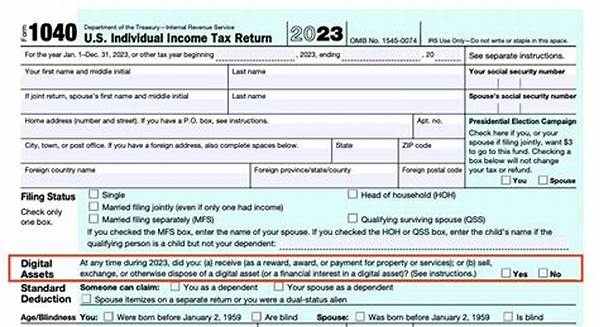

The appeal of cryptocurrency, particularly for the younger demographic, often lies in its perceived anonymity and revolutionary potential. Many jump into the crypto scene with dreams of rapid wealth accumulation and disrupting traditional financial systems. However, as the popularity of digital currencies surges, so does the scrutiny from tax regulatory bodies like the IRS in the United States. The IRS views cryptocurrency as property, meaning every transaction can potentially lead to a taxable event. Failing to report these transactions properly due to misunderstanding or misinformation regarding tax obligations can land young investors into deep trouble.

The consequences of making the #1 crypto tax mistake that lands young investors in hot water with the IRS can be severe. Penalties for not accurately reporting crypto transactions might range from fines to more severe legal repercussions. It’s crucial to recognize that, contrary to the myth of untraceable transactions, the IRS has platforms and tools enabling them to track all activities involving cryptocurrencies. For instance, exchanges often report transactions to the IRS, further reducing the anonymity facet many young investors bank on.

How to Avoid the #1 Crypto Tax Mistake That Lands Young Investors in Hot Water

It’s imperative for young investors to educate themselves on the crypto tax landscape. Schools don’t teach this, and it’s not commonly discussed at dinner tables yet, making self-education vital. Understanding that any crypto transaction—be it buying, selling, trading, or even receiving as a gift—is a taxable event helps in staying prepared. Seeking professional advice or using specialized crypto tax software can prove invaluable in keeping those IRS wolves at bay. Remember, smart investing includes understanding your legal obligations and planning for them.

Pengenalan

Understanding the crypto market’s allure is not only about potential earnings but also about staying informed and responsible for tax obligations. Cryptocurrency has swiftly climbed the ladder from an obscure internet marvel to a mainstream financial instrument. As young people rush towards this goldmine with aspirations of financial freedom, the reality of taxes seems a far-off concern for many. This disconnect between ambition and awareness often leads to the #1 crypto tax mistake that lands young investors in hot water with the IRS!

There’s an exhilarating sense of autonomy in trading cryptocurrency; it’s a self-driven market where participants globally are interconnected through the digital financial web. However, amidst the excitement of seamless transactions and a 24/7 exchanges, the dark cloud of tax negligence looms ominously. Many young investors innocently assume their transactions are private, shielded from governmental oversight, due to the decentralized nature of these currencies.

Unmasking the Crypto Tax Misunderstanding

The reality, as stark as it may seem, is that no financial endeavor is devoid of tax implications. The IRS’s firm stance on crypto taxes draws from the basic understanding that these digital currencies are assets and are subject to capital gains tax, just like stocks or bonds. It’s this misconception that often trips up young traders, who mistakenly regard crypto as an unregulated and tax-free domain.

Comprehensive Awareness is Key

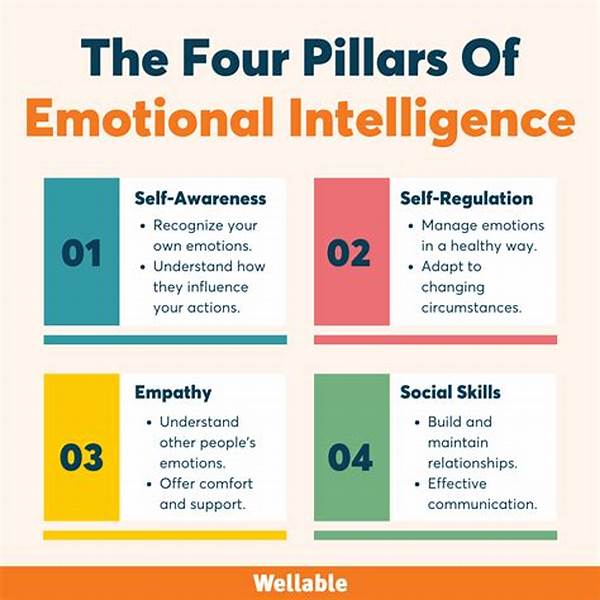

Avoiding the #1 crypto tax mistake that lands young investors in hot water with the IRS mandates comprehensive awareness. It’s necessary to dispel myths surrounding crypto taxation. As part of responsible investing, it’s advisable for young traders to leverage educational resources, attend seminars, or even subscribe to financial advisors specializing in crypto taxes. Only by understanding the rules can they sidestep critical slips and safeguard their investments.

Key Takeaways on Crypto Tax Mistakes

Crafting a Tax-Savvy Crypto Investor Profile

The right approach to investing in cryptocurrency integrates deliberate tax planning. Young investors must build a robust understanding of their duties, ensuring that every trade and transaction aligns with tax regulations. Utilizing tools like crypto tax software or hiring a tax advisor with cryptocurrency experience can help mitigate risks and maximize post-tax returns.

Becoming Aware of The #1 Crypto Tax Mistake and Solutions

Understanding The Taxation Pitfalls

While the world of crypto presents boundless opportunities, overlooking tax obligations remains a pitfall for many. The IRS’s increasing vigilance on all crypto-related activities means young investors must take proactive steps to ensure compliance. Understanding the distinction between capital gains and losses is vital. If you liquidate crypto holdings at a profit, you owe capital gains tax. Conversely, losses can often be deductible.

By realizing the #1 crypto tax mistake that lands young investors in hot water with the IRS, young investors can implement strategic measures to mitigate liabilities. To avoid falling into this trap, awareness and education are critical. Utilizing available resources can aid in making calculated decisions that protect and grow wealth prudently.

Navigating Crypto Tax Liability

Establishing an effective tax strategy is as pivotal as the investment strategy itself. The key is to not only focus on current returns but to understand future tax implications and plan accordingly. With the regulatory landscape continuously evolving, staying abreast of the latest developments in crypto regulation can guard against unwelcome surprises.

Promoting a relationship with financial advisors acquainted with cryptocurrency can aid in expertly navigating these waters. Regular consultations ensure an investor’s tax approach is adapted to the latest IRS guidelines. As the saying goes, knowledge is power—and in this case, it’s the power to keep the IRS at bay and keep one’s investments flourishing without hindrances.

Six Tips for Avoiding the #1 Crypto Tax Mistake

Deskripsi:

Amidst the thrill of engaging with cryptocurrencies, the specter of taxes is both daunting and often overlooked. Young investors entering the crypto market are met with challenges that reach beyond market volatility and into the sphere of legal obligations. The overarching fear of the #1 crypto tax mistake that lands young investors in hot water with the IRS is rooted in misinformation and lack of preparation. But this fear need not materialize if the importance of crypto tax compliance is understood and embraced.

Action begins with recognizing the necessities of informed trading. It’s not merely about accumulating wealth but doing so legally and ethically. Simple steps such as educating oneself, deploying the right software, consulting with experts, and maintaining meticulous records can defend against unwelcome IRS notices. Cryptocurrency may be the future of finance, but prudent investors will ensure their journey is free from unnecessary legal entanglements.

Closing Thoughts on Crypto Tax Mistakes

Emphasizing Awareness and Education

Without a doubt, the evolving world of cryptocurrency continues to lure young, ambitious investors. The missing puzzle piece often remains an understanding of taxes, as many believe that profits should overshadow any concerns about reporting. Reality, however, requires an education that ensures all gains comply with tax laws.

The bustling life of a young investor may not prioritize tax awareness; yet, a responsible approach necessitates it. Avoiding cryptic surprises from the IRS revolves around grasping important distinctions in how different transactions are treated and taxed. As the tension between innovation and taxation mounts, astute young investors will rise above by reinforcing their tax strategies with knowledge and foresight.

Moving Toward Responsible Crypto Trading

Empowering young crypto enthusiasts revolves around shedding light on these hidden pitfalls. Mistakes like failing to report transactions or misunderstanding capital gains tax scenarios can indeed be the #1 crypto tax mistake that lands young investors in hot water with the IRS. However, through deliberate education, understanding, and action, these same investors can transform into tax-savvy juggernauts who navigate cryptocurrency’s realms with immunity from IRS sanctions. The future awaits, and it’s time to face it with foresight and preparation.