How To Balance Fun Spending Without Guilt

Balancing fun spending with responsible financial management is both an art and a science. We all want to enjoy life’s pleasures without constantly worrying about our bank accounts. Imagine savoring that delicious latte, attending an energetic concert, or traveling to new landscapes without the nagging feeling that you’re overstepping your budget. The ultimate goal is to embrace enjoyable activities and purchases with a sense of balance and prudence. This guide will equip you with the strategies to achieve this delicate balance, leaving you guilt-free and financially secure.

Read More : Best Ways To Track Subscriptions And Cut Costs

Fun spending doesn’t have to be synonymous with financial irresponsibility. In fact, when done correctly, it can be empowering. It reflects a modern attitude towards money, where individuals are encouraged to enjoy the fruits of their labor. Imagine walking into a store, purchasing something frivolous yet delightful, and feeling absolutely no remorse. That’s the essence of how to balance fun spending without guilt—it’s about maintaining financial harmony and cherishing life’s small pleasures simultaneously.

Think of this as a journey where you’re both the driver and the navigator, steering yourself towards financial wisdom fused with cheerful indulgence. This isn’t just another financial advice article; it’s a transformative approach to spending—artful, measured, and exhilarating. Over the next few sections, delve into how to unlock a world of financial joy and wisdom, where your needs, wants, and whims coexist peacefully. Are you ready to start this adventurous exploration? Let’s dive in!

Strategies for Enjoyable and Responsible Spending

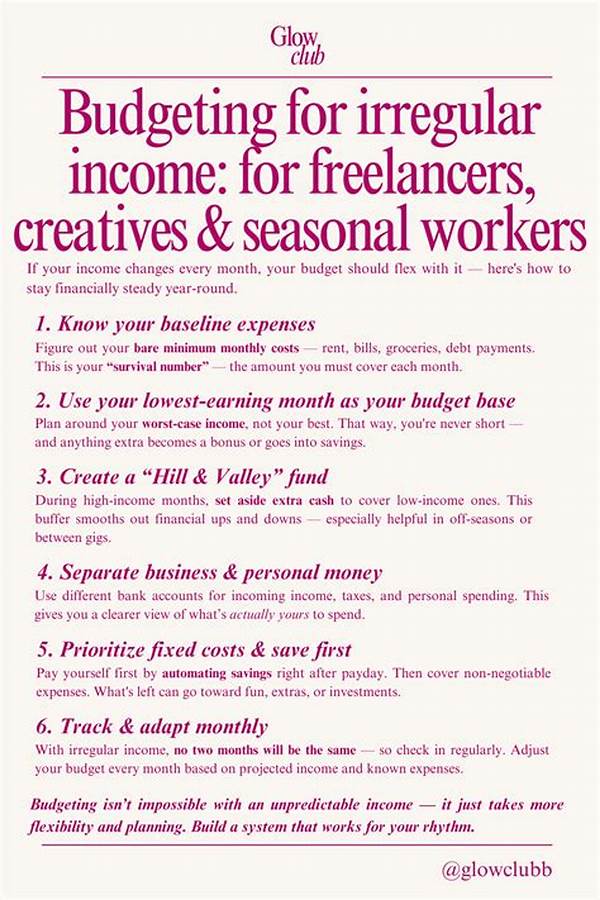

When it comes to mastering the art of how to balance fun spending without guilt, consider adopting a budgeting method that incorporates dedicated funds for leisure and entertainment. This strategic approach not only encourages you to enjoy life’s pleasures but also imparts a sense of empowerment by giving you control over your finances. Imagine a budget that allows for spontaneous dinners out, movie nights, or even impulse buys without stress. This method liberates you from guilt while keeping you financially grounded.

Many opt for the “50/30/20 budget rule,” which allocates 50% of your income to necessities, 30% to personal wants, and 20% to savings. This categorization ensures that leisure spending is baked into your plan, allowing for guilt-free enjoyment. Picture Saturday nights out or weekend getaways planned well in advance, so they fit seamlessly into your budget. With this control, you can savor experiences without feeling financially strained.

Here’s an insider tip: always stash away a small percentage purely for spontaneous fun! It’s that headroom in your budget that covers an unplanned outing, a last-minute concert ticket, or an unexpected sale. Think of it as a “fun fund” nurturing your happiness and leisure without leaving a dent in your finances. Life is unpredictable, and this cushion not only makes room for spontaneity but also safeguards your financial equilibrium.

Another smart practice is engaging in financial reflection post-purchase. Ask yourself: Did this spending bring joy? Could it have been executed more economically without sacrificing excitement? This retrospective evaluation helps in honing your spending habits and aligns them with your long-term goals. By actively learning from each spending instance, you can fine-tune your behaviors to ensure perpetual balance between fun and fiscal responsibility.

Emotional Tips for Guilt-Free Spending

Balancing fun spending without guilt is an achievable, liberating pursuit that enhances not only your financial health but also your quality of life. By incorporating these strategies into your daily financial routine, you’ll empower yourself to make joyful and responsible spending decisions, proving that financial prudence and enjoyable living can indeed coexist harmoniously.