Why Credit Utilization Ratio Matters Most

In the intricate world of personal finance, the credit utilization ratio stands as a phrase often whispered amongst financial advisors, akin to a secret key that unlocks the realm of impeccable credit health. Picture this: you’re navigating the financial ocean without chart or compass, and suddenly, a gleaming lighthouse—your credit utilization ratio—pierces the fog. It’s the unsung hero on your credit report, quietly exerting a profound influence on that all-important credit score. Its significance is not just a matter of numbers; it is an overwhelming tide that shapes the fiscal destiny of countless individuals.

Read More : New Research Alert: This Popular Crypto Wallet Is Facing Major Security Vulnerabilities!

Credit utilization can be best imagined as a balancing act, juggling the elegance of fiscal responsibility with the harsh reality of debt consequences. This ratio is the division of your credit card balances by your credit limits, expressed as a percentage. Why does it matter most? Because financial institutions use this magic number to gauge how well you manage your available credit and, by extension, your risk level as a borrower. It’s the intertwined dance of opportunity and limitation, offering a peek into your discipline in navigating credit.

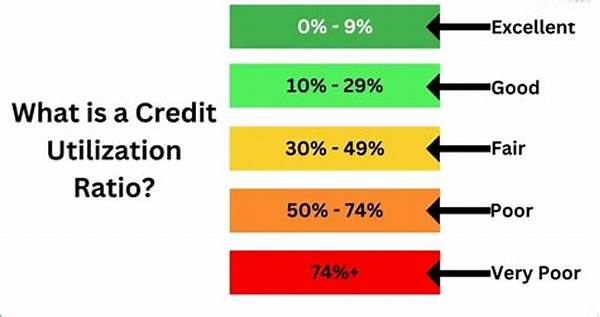

Imagine your finances dressed up for a gala, and your credit utilization is the dazzling accessory drawing admirers from all corners. It’s no joke—your score can swing wildly based on this single factor. Statistics reveal that a credit utilization ratio under 30% is typically viewed as favorable, but while aiming for a lower ratio, it is not merely about being seen as a creditworthy individual. It’s a profound declaration of your awareness in the financial ecosystem, a rallying cry in a language that lenders fluently understand.

However, the real kicker—the plot twist in this fiscal novella—is found in understanding why credit utilization matters most beyond the confines of your score. It’s about control. Mastering your credit utilization ratio means you’re not just a number to lenders. You’re a conscious financial navigator, capable of leveraging opportunities with nuance and tact.

The Impact of Credit Utilization Ratio on Your Financial Picture

In today’s fast-paced world where credit is king, your credit utilization ratio holds a secret power. Picture it as the backstage pass in your financial concert, granting you access not just to a stellar credit score, but a robust financial existence. For many, it is a revelation once they truly grasp why credit utilization ratio matters most, not just in theory but in the real, slippery rollercoaster of life’s financial anxieties.

—

The financial landscape is a formidable, complex machine. At its heart is your ability to maintain good credit, which can make or break major financial decisions. Not convinced? Well, gather ’round, dear reader, and let me spin you a tale. There was once a young professional named Alex, drenched in student debt and trying desperately to land a lease on a new apartment. Despite a steady income, Alex’s seemingly solid credit history was sabotaged, almost ruinously, by a sky-high credit utilization ratio viewed suspiciously by potential landlords.

It hits like a bad punchline in an otherwise finely crafted joke: why credit utilization ratio matters most is because it’s a snapshot of your financial habits at any given moment. More than just a number, it’s a reflection of discipline or distress. It can quickly elevate you as a borrower or plummet you into the depths of risk in the eyes of lenders. This skyrockets in awareness as more people find themselves in situations similar to Alex, illustrating how a high credit utilization ratio can skew perception and opportunities alike.

A survey of finance professionals sheds light on this fundamental piece of the credit puzzle. Many testify that clients often overlook this aspect, underestimating its impact. Within their tales lies an emotional stake—aching opportunities squandered over negligently managed ratios. But what if you could rewrite this narrative? What if that villainous figure looming over your finances became an ally instead?

Insights from Financial Experts

Financial experts frequently emphasize the pivotal role of the credit utilization ratio in shaping your borrowing potential. It’s not merely an academic exercise; it’s the metric that can heavily guide your financial destiny. Blending creativity with careful management, you can leverage your knowledge about this ratio for more favorable loan terms or better credit offers. Why does the credit utilization ratio matter most? Because in modern credit scoring, it’s not just about how much credit you have, but how strategically you use it.

Becoming Friends with Your Credit Utilization Ratio

Herein lies the beauty of mastering the credit utilization ratio. It’s about fostering a relationship that nurtures your financial health. So the next time you swipe your credit card, imagine yourself as a tightrope walker, balancing not only expenses but also the future financial potential and stability.

—

10 Key Takeaways on Why Credit Utilization Ratio Matters Most

—

A financial savvy individual is often akin to a superhero, navigating myriad credit offers and tantalizing loan terms. Yet beneath the cloak of fiscal heroism lies an often misunderstood figure—the credit utilization ratio. Fancy a foray into why credit utilization ratio matters most, dear reader? Picture a shimmering gateway that determines fate akin to opening golden doors to financial prosperity or security.

Intriguing Aspects of Credit Utilization Ratio

This simple yet potent ratio is the unsung melody in the grand symphony of personal finance. Understanding why credit utilization ratio matters most can act like an exhilarating revelation comparable to discovering a secret superpower. Imagine wielding this power at a negotiation table—whether securing a lower interest rate on a new loan or impressing a potential landlord with your impeccable credit.

Consequences of Mismanagement

Now, let’s explore the dark alley of consequences when mismanaged. A looming shadow of debt may rise, and opportunities once vibrant with possibility now wither. It’s akin to an ominous cloud over your financial independence. Cracking the code to managing your credit utilization instantly transforms it from nemesis into ally, showcasing your financial discipline to the world.

Thus, keeping a watchful, educated eye on this ratio isn’t just a suggestion; it’s the cornerstone of a sound, future-proof financial strategy. Harness its power and forge ahead towards a realm where the question, “why credit utilization ratio matters most,” becomes a triumphant affirmation of your smart financial strategy.

—

Illustrating Why Credit Utilization Ratio Matters Most

Every prudent spender understands the delicate balance of managing their credit profile, and the utilization ratio acts as both guardian and tool to achieve financial success. As credit score parameters continually evolve, understanding the gravity of this underrated aspect of credit becomes an essential chapter in one’s financial competency manual. Monitoring this ratio is like having a traffic signal that guides you through the avenues of credit management wisely and effectively.