Budgeting Challenges That Actually Build Wealth

- Budgeting Challenges That Actually Build Wealth

- Embracing Financial Hurdles: Turning Obstacles into Opportunities

- Key Takeaways: Budgeting Challenges That Actually Build Wealth

- Discussing the Impact of Budgeting Challenges on Wealth Building

- Wealth-Building Through Budgeting Challenges: Strategies and Solutions

- Understanding the Benefits of Budgeting Challenges

- The Power of Financial Challenges in Cultivating Wealth

Budgeting Challenges That Actually Build Wealth

In the dynamic world of finance, saving and growing wealth can often feel like two opposite sides of a coin. Many people set out with the honest intention of building a solid financial foundation, yet find themselves struggling amidst various budgeting challenges that actually build wealth. This journey is not merely about tightening the proverbial belt; it involves strategic planning, introspection, and at times, quite a bit of humor. Imagine entering a world where every financial decision is a puzzle, where each piece you fit brings you closer to financial freedom. This is the landscape of budgeting challenges that actually build wealth—a financial odyssey with lessons that are as entertaining as they are enlightening.

Read More : Budgeting And Saving Apps

The Unseen Potential in Budgeting Struggles

The road to financial success is paved with obstacles that test your determination and creativity. Interestingly, these very obstacles are the stepping stones to wealth accumulation. For instance, one of the most common challenges is managing fluctuating income streams. Many of us don’t have the luxury of a fixed paycheck, and this unpredictability can force us to think about money in innovative ways. By confronting such challenges head-on, individuals enhance their ability to adapt to changing circumstances, which is an invaluable skill both personally and professionally.

Budgeting challenges that actually build wealth do not merely focus on tightening your belt but rather invite a more profound understanding of financial intelligence. Building wealth involves not just saving but also making informed decisions about investments. Many people find themselves challenged by how to allocate their funds effectively. This ordeal drives them to learn more about stocks, bonds, and other investment options, which in turn, enables smarter financial decisions with greater long-term benefits.

Another aspect is the emotional roller coaster involved with budgeting. Fear of missing out (FOMO) or the urge to indulge can pose major hurdles. However, overcoming these emotional challenges leads to greater financial discipline and awareness. When individuals resist the temptation to overspend, they often end up discovering inventive ways to enjoy life within their means, tapping into resources they never knew existed. Embracing these budgeting challenges that actually build wealth finances a lifestyle that’s not only sustainable but also deeply rewarding.

Reframing Budgeting Challenges as Opportunities

The secret sauce to converting budgeting hurdles into wealth-building opportunities lies in reframing your perspective. Consider each challenge not as a roadblock but as an opportunity for growth. When you perceive unpredictable expenses or income fluctuations as puzzles to solve, you can empower yourself with new financial strategies. In the grand theater of personal finance, creativity and a shift in mindset can turn struggles into strategies that fuel both personal and financial growth. So, how do you navigate this thrilling yet challenging path and ensure that your financial puzzles lead to prosperity? By looking at these budgeting challenges that actually build wealth as opportunities for growth, learning, and understanding your financial landscape better.

Conclusion

Budgeting challenges that actually build wealth do not have to be daunting. Instead, they provide a powerful lesson in financial mastery and personal growth. As you embark on this journey, remember that every obstacle overcome is a step closer to your ultimate financial success. Dive in with confidence, a sense of humor, and the curiosity to learn—and watch as what once were challenges evolve into pathways of prosperity and wealth-building success.

—

Embracing Financial Hurdles: Turning Obstacles into Opportunities

The journey to financial success is never without its set of unique struggles, but what if those very struggles could become the foundation for wealth? The concept of leveraging budgeting challenges to build financial success isn’t new, yet it’s often overlooked. Many people view these challenges as barriers when they are, in fact, educational moments that lead to better financial understanding and decision-making.

Understanding the Importance of Budgeting Challenges

Let’s delve into why these budgeting challenges matter. The unpredictable nature of income or the temptation to spend recklessly are just two examples of hurdles that force a deeper understanding of financial management. When you face these issues head-on, you are compelled to find innovative solutions, thereby enhancing your financial literacy. As a result, you start to recognize the myriad of opportunities those challenges present, leading you towards wiser financial choices in the long run.

Emotions and Financial Decision Making

Emotional influence on financial decisions is often underestimated. Whether it’s fear, desire, or reluctance, emotions can steer us off the financial path quickly. However, facing these emotional challenges within budgeting allows individuals to practice emotional intelligence. The ability to recognize and manage your emotions enables you to make rational decisions that prioritize long-term financial goals over short-term emotional satisfaction. It’s akin to flexing a muscle; the more you use it, the stronger it gets.

Strategies for Tackling Budgeting Challenges

There’s no one-size-fits-all solution to budgeting, but strategies can certainly mitigate the stress of financial management. Start with creating a flexible budget that can adapt to fluctuating income and expenses. Incorporate regular reviews of your budget to align with changing goals. Equip yourself with knowledge—understand investment basics and diversify your portfolio. These steps, among others, transform the intimidating concept of budgeting into a more manageable and even enjoyable process.

In summary, the road to wealth is challenging, filled with hurdles that require innovation and courage. By facing these challenges head-on and transforming them into opportunities, you lay the foundation for lasting financial success. The path of budgeting challenges that actually build wealth is not only a testament to personal growth but also a powerful strategy for financial freedom.

—

Key Takeaways: Budgeting Challenges That Actually Build Wealth

Discussing the Impact of Budgeting Challenges on Wealth Building

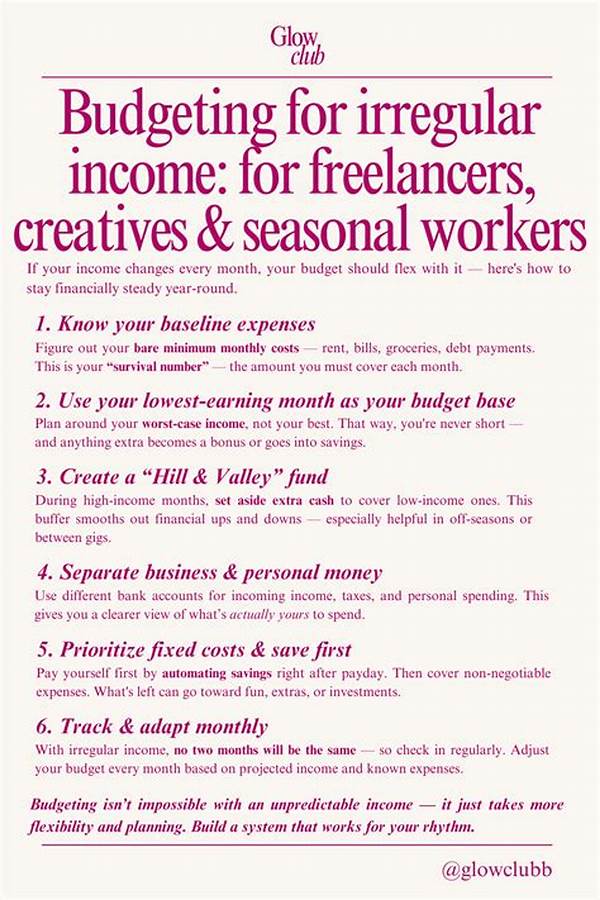

The discourse around budgeting often centers on its intimidating aspects, yet those very challenges are integral to building wealth. Let’s unpack this notion, starting with the unpredictability of financial life. Many people, especially freelancers and entrepreneurs, face the challenge of fluctuating incomes, seeing this as a stressor when in fact, it’s a lesson in resourcefulness. This unpredictability forces individuals to budget creatively and prioritize savings, a practice that inadvertently lays the groundwork for financial security.

The emotional element of budgeting challenges also deserves attention. Often, individuals feel compelled to spend beyond their means due to societal pressures or emotional desires. However, tackling this challenge nurtures discipline. It teaches the invaluable lesson of differentiating between wants and needs. Overcoming impulsive financial habits does not just improve the current financial state; it sets a precedent for future financial health.

Furthermore, these budgeting challenges encourage financial education. When faced with overspending or inadequate savings, many turn to financial resources for guidance. This pursuit of knowledge can lead to exploring investment opportunities or better money management techniques—skills that contribute significantly to wealth accumulation. The act of turning a challenge into a curiosity-driven exploration enriches financial understanding and prepares individuals for smarter decision-making.

Ultimately, embracing budgeting challenges rather than avoiding them is a proactive step towards wealth creation. By understanding the underlying issues and developing solutions, individuals not only overcome these challenges but actually emerge stronger. They become adept at managing their finances, ready to face any new challenges with a strategic approach. In this way, budgeting challenges that actually build wealth become the foundational blocks for financial independence and prosperity.

—

Wealth-Building Through Budgeting Challenges: Strategies and Solutions

Embracing Financial Complexity

The financial landscape is complex, but it’s within this complexity that opportunities for wealth building sprout. Many find themselves overwhelmed by the intricacies of budgeting—setting limits, tracking expenses, and saving for the future. This struggle, however, acts as a crucible, purifying financial habits and understanding.

Strategic Budgeting Approaches

To effectively navigate this financial labyrinth, adopting strategic approaches to budgeting is crucial. This involves creating a flexible budget that considers variable incomes and expenditures. Flexibility ensures you can adjust to changes without derailing your financial plans.

Harnessing Budgeting Challenges for Growth

Budgeting challenges that actually build wealth are a journey rather than a destination. They teach resilience and foresight, allowing you to anticipate future bumps. Facing these challenges isn’t about survival; it’s about evolving into a financially savvy individual who can use these lessons to foster a flourishing financial ecosystem.

Each budgeting hurdle presents a unique learning opportunity. Whether it’s reconciling an unexpected expense or adjusting for an income dip, each scenario enriches your financial toolkit. Equipped with adaptability and understanding, you’re better prepared to transform these obstacles into wealth-building strategies.

—

Understanding the Benefits of Budgeting Challenges

The Power of Financial Challenges in Cultivating Wealth

Budgeting challenges may initially seem daunting, yet they hold the key to financial empowerment. Navigating through unpredictable financial scenarios demands resourcefulness, prompting individuals to seek effective budgeting strategies. This proactive stance not only mitigates existing issues but also paves the way for future wealth accumulation.

The emotional side of financial challenges also offers valuable insights. Understanding and controlling emotional spending—driven by societal pressures or personal desires—creates a disciplined approach to finance. It’s through these lessons that individuals can distinguish between wants and needs, ultimately leading to more effective wealth management.

Furthermore, addressing budgeting challenges propels individuals towards financial education. By seeking out resources and learning about investments, people arm themselves with the knowledge needed for judicious financial decisions. This education lays the groundwork for a financially secure future.

In embracing these challenges, we don’t just overcome obstacles; we set the stage for sustainable financial success. Through understanding, adaptability, and informed decision-making, budgeting challenges truly become tools for building lasting wealth.