Best Budgeting Strategies For College Students

Navigating college life can be an exhilarating yet financially challenging journey. As a college student, mastering the skill of budgeting is crucial not just for surviving but for thriving. The importance of adopting the best budgeting strategies for college students cannot be overstated. When lectures, assignments, social events, and every other vibrant aspect of student life beckon, the last thing you want is to constantly worry about finances. In this article, we’ll dive into the art of budgeting, making sure your experience on campus is rich not only in academics but also in life’s wonderful adventures.

Read More : Budgeting And Saving

The path to financial wisdom starts with understanding the landscape. Statistics show that nearly 70% of college students are stressed about finances. This stress can overshadow academic performance, social relationships, and mental health. Yet, the flipside shows promise: those who employ efficient budgeting strategies report higher satisfaction levels, both academically and personally. Budgeting may seem daunting at first, akin to learning a new language. However, like any language, with persistence and practice, fluency comes.

Imagine the peace of mind when you know exactly how each dollar is working for you, whether it’s your tuition, living expenses, or social outings. Many students, who’ve taken control of their finances, testify to the empowering feeling of dictating where their money goes rather than wondering where it went. As you journey through these fiscally formative years, our exploration into the best budgeting strategies for college students will serve as your reliable guide.

Understanding the Basics of College Budgeting

You might ask, “Where do I start?” The first step is creating a detailed monthly budget. This budget should encompass all income sources—parental support, part-time jobs, scholarships, and any other revenue streams. It’s essential to log every expected expense, from tuition and books to housing, food, and recreational activities. According to recent research, students who maintain a budget are 33% less likely to overspend. Setting realistic parameters is vital, ensuring that savings aren’t left as an afterthought but become a consistent part of budgeting habits.

Goals for Implementing Budgeting Strategies

In college, your status shifts from a dependent teenager to a young adult responsible for your financial decisions. Hence, developing best budgeting strategies for college students isn’t just an option but a necessity. These strategies act as both a map and compass, ensuring you not only stay afloat financially but also reach greater shores of fiscal independence and confidence. But more than that, effective budgeting will equip you with essential life skills that will be indispensable long after you toss your graduation cap into the air.

Establish a Spending Plan

Setting a spending plan is akin to creating a blueprint for a building. Without a plan, construction is chaotic—with one, each step is purposeful. In terms of college budgeting, this means deciding beforehand how much you’re willing to spend on essentials like rent, food, and utilities, and how much is left for discretionary spending.

The best budgeting strategies for college students demand clarity. Assess your monthly expenses diligently. Armed with this data, you’ll have a comprehensive view of where potential savings lie. Utilize apps and tools specifically designed to aid in personal finance management, enabling portability and precision in monitoring your expenses.

Embrace the Student Lifestyle

Adopting the student lifestyle unequivocally means capitalizing on discounts. Many retailers, both brick-and-mortar and online, offer student discounts, which can translate to significant savings. Whether it’s selecting a cost-effective meal plan, sharing textbooks through rental platforms, or leveraging public transportation, every dollar saved counts. The best budgeting strategies for college students are often disguised as these simple, money-saving hacks.

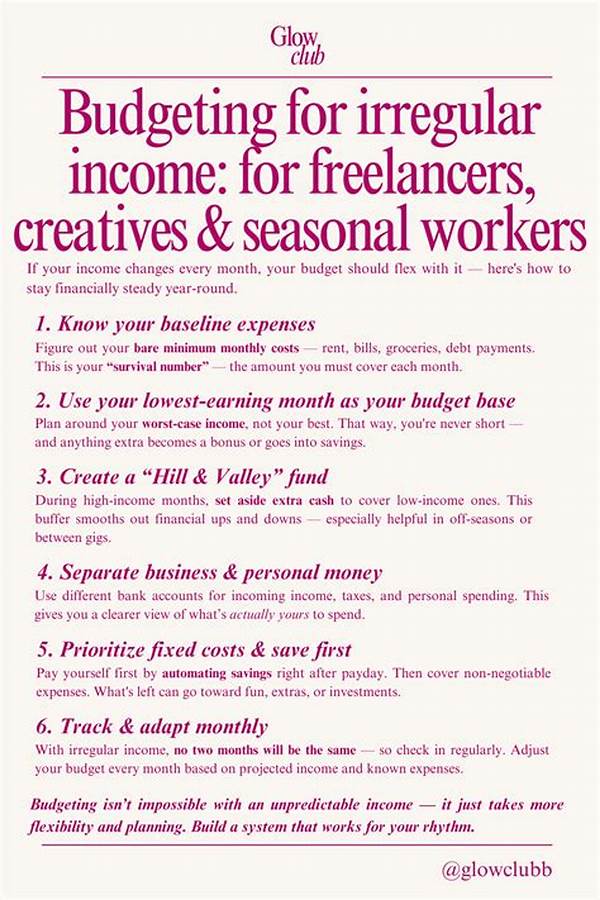

Another approach involves generating additional income streams, such as part-time jobs or freelancing gigs that align with your academic schedule. The balance between work, study, and relaxation is crucial, but weaving in a job or two can greatly alleviate financial strain.

Steps to Master College Budgeting

Budgeting successfully isn’t just about cutting back; it’s about making informed choices and maximizing available resources. Here’s how you can begin designing a financially savvy college experience:

Determining the Structure of Budgeting

The intricacies of budgeting can be imagined as a layered structure. At its foundation is the simplification of expenditures, made possible through conscientious decision-making. A methodical breakdown—such as the 50/30/20 rule, where 50% equals needs, 30% equals wants, and 20% earmarked for savings—is often employed by students.

The structure extends beyond percentages; it incorporates financial literacy—understanding terms, interpreting financial news, recognizing investment opportunities, and effectively managing student loans. Online courses and workshops offer students opportunities to expand their finance-related knowledge, promoting informed decision-making.

The Purpose of Best Budgeting Strategies for College Students

Budgeting, while vital, is not universally approached with the excitement it deserves. While the term might conjure images of spreadsheets and calculators, its implementation acts as a buffer between financial insecurity and peace of mind. The college environment, rich with opportunities and experiences, is best enjoyed when financial stress is minimized. Proper budgeting transforms theoretical ideals into practical realities, empowering students with choice, control, and change.

Perceiving the Role of Budgets

Budgets might appear as financial restrictions to some, when in reality, they’re empowering tools—a perspective shift crucial for students. The best budgeting strategies for college students aren’t about limiting potential experiences but rather enhancing them by ensuring that each choice reflects both current satisfaction and future aspirations.

The Emotional Impact of Financial Management

Stress relief is one of the hidden gems of precise budgeting. Knowing you have prepared for contingencies and are comfortable with your spending allows mental space to focus on studies, hobbies, and social interactions. Our financial health significantly influences our mental well-being; thus, these best budgeting strategies for college students are designed with a holistic viewpoint.

With these insights, it’s your turn to embrace these strategies and craft a college experience that’s not only educational but financially enriching.