Investing In Rental Property For Beginners

- Taking the First Steps in Property Investment

- Introduction to Investing in Rental Property for Beginners

- Laying the Foundation for Success

- Goals of Investing in Rental Property for Beginners

- Learning From Experienced Investors

- Illustrations for Investing in Rental Property for Beginners

- A Beginner’s Journey in Real Estate Investment

- Building Connections: The Importance of Networking

- Leveraging Technology in Property Management

- The Psychological Aspect of Investment

Embarking on the journey of real estate investment is much like venturing into uncharted waters—exciting, promising, and occasionally daunting. The allure of steady cash flow, potential appreciation, and tax benefits can be immensely appealing. But like any seasoned sailor will tell you, preparation is key to navigating the seas smoothly. Investing in rental property for beginners offers a rewarding pathway to building wealth, yet it requires understanding, patience, and strategic planning.

Read More : The 3-step Routine: A Simple Weekly Ritual To Review Your Portfolio Without Overreacting!

Imagine standing at the threshold of your newly acquired property, the front door creaking open as you step inside. The potential fills the air, the echoing rooms whispering promises of future tenants and rental income. For those beginning their investment voyage, the prospect may seem overwhelming. Where to start? What kind of property to buy? How to manage it? These are common questions, yet the answers are often simpler than expected.

For beginners, the critical first step is education. Gain an understanding of the market you’re entering, the risks involved, and the kind of return you can realistically expect. It’s not just about buying a property at a low price and renting it out—it’s about knowing the neighborhood, understanding tenant needs, and creating a strategy to maximize both occupancy and profitability. Successful real estate investors understand the importance of due diligence—from researching property taxes to analyzing potential cash flow.

While the process may initially seem like navigating a maze, it becomes clearer with every turn taken. Envision a future where your rental properties provide you with passive income, allowing you to chase other dreams without financial stress. Moreover, the wealth of resources and services available today—from property management companies to investment courses—makes the journey more accessible than ever. With dedication and the right guidance, investing in rental property for beginners can turn into a lucrative and fulfilling endeavor.

Taking the First Steps in Property Investment

Understanding the essentials is crucial for those who are keen on investing in rental property for beginners. Start by setting clear financial goals and determining how this investment aligns with them. It’s important to assess your financial situation—consider how much you can afford to invest, your credit score, and whether you’ll need a loan. Partnering with financial advisors or real estate experts can be beneficial in mapping out your initial strategy.

—

Introduction to Investing in Rental Property for Beginners

When we talk about “investing in rental property for beginners”, we’re diving into a vibrant world brimming with opportunity, growth, and the occasional hair-raising moment. Imagine the feeling of receiving your first rental check, the reassurance of seeing your investment in brick and mortar, and the satisfaction of knowing you made a smart financial choice. But let’s face it—taking the first plunge can be intimidating. Fear not, as this guide is your compass, designed to steer you through the choppy waters of property investment with a smile.

Have you ever stumbled across a blog, vividly describing an investor’s journey from a small apartment to a sprawling empire? These stories provoke a sense of inspiration and evoke the dormant entrepreneur in us. They unveil the secret sauce—diligence, a splash of creativity, and unwavering perseverance. For those considering the dive, think of this as your personalized treasure map, pointing you towards the lands filled with rental prosperity, with “investing in rental property for beginners” as the X marking the spot.

Picture your investment property as a blank canvas, each tenant adding vibrant strokes of life throughout the years. Just as a painter understands their brush and colors before the first stroke, an aspiring property investor must grasp fundamental concepts before unlocking the potential of rental income. Begin by embracing the art of property selection—location, amenities, and market trends are your palette. Study them well, for they dictate the masterpiece’s value and appeal.

Let’s bring to life the common challenges beginners face; financing woes, tenant dilemmas, and maintenance headaches. Addressing these with a touch of humor and practicality enhances comprehension and retention. While navigating these topics, continual learning and adaptation are crucial. Attending seminars, reading industry news, and networking with fellow investors can be invaluable in ensuring your property remains an asset rather than a liability.

Laying the Foundation for Success

Knowledge is your best friend in this domain. Delve into real estate investment courses specifically tailored for beginners. These courses typically address everything from market analysis to property management. Moreover, joining online forums offers insights and shared experiences, granting wisdom beyond one’s own experience. Remember, the realm of “investing in rental property for beginners” is vast and continuously evolving, making education a lifelong companion in your journey.

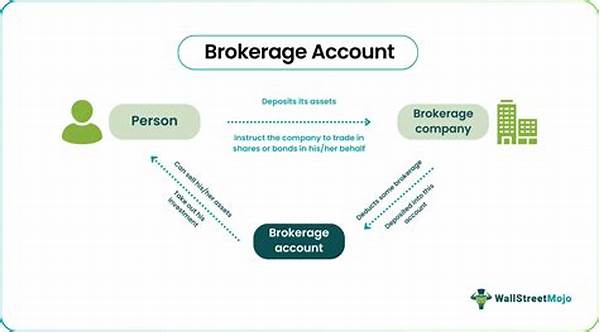

Financial Planning in Real Estate Investment

The financial aspect cannot be overlooked when examining investing in rental property for beginners. Starting with a strong financial base is akin to laying down concrete for your property’s foundation. Evaluate your budget meticulously, outline clear financial goals, and consider employing a reliable property management service if managing tenants seems daunting. With strategic financial planning, your property investment journey will be smoother and more rewarding.

—

Goals of Investing in Rental Property for Beginners

Engaging actively in investing in rental property for beginners opens up a myriad of avenues for financial growth and personal development. Each step taken reveals new learning opportunities, whether negotiating with a particularly tough tenant or finding an innovative financing method. Engaging with essential goals ensures a prepared and strategic approach to property investment.

One of the most vital aspects of property investment is selecting properties that align with your financial and lifestyle goals. As straightforward as it might seem, the task requires an in-depth analysis of current market trends, a thorough understanding of property values, and an intuitive sense of what potential tenants seek. However, getting this aspect right forms a solid foundation for sustained success.

Networking within the realm of real estate is equally important. Establishing connections with experienced investors, real estate agents, and property managers can provide invaluable insights and opportunities. Consider engaging in community meet-ups or online forums where like-minded individuals share tips, strategies, and experiences. The collective wisdom can often guide beginners around potential pitfalls.

Lastly, the journey of investing in rental property for beginners is one marked by continual adaptation and learning. Real estate markets evolve along with economic trends, demographic changes, and technological advancements. Staying ahead of these changes, through education and adaptability, ensures a sustained and prosperous investment venture.

Learning From Experienced Investors

Observing and learning from those who have forged successful paths in real estate can significantly shorten your learning curve. Listen to experienced investors’ stories, challenges, and achievements. By comparing these accounts, you can tailor your strategy to encapsulate success while mitigating potential risks.

Tools and Resources for Property Investors

Making use of available resources, such as property management software or financial advisory services, can streamline many aspects of investing. Whether you seek analytics tools for market research or software for managing tenant relationships, leveraging these technologies ensures you remain efficient and competitive.

—

Illustrations for Investing in Rental Property for Beginners

Visualizing the key components of investing in rental property for beginners not only makes the concept more approachable but also aids in retaining the diversified strategies needed for effective investment. Each illustration represents an integral part of the investment journey, emphasizing the multifaceted approach to becoming a successful property investor.

Every illustration, like the first viewing of an empty apartment filled with potential, acts as a powerful motivator. It reminds the investor of the endless possibilities awaiting discovery and creativity in designing a profitable space. Meanwhile, attending seminars as depicted in the illustration of novice investors offers an avenue to acquire knowledge essential for broadening investment and management strategies.

Networking, denoted by the gathering of investors, enhances insight-sharing, opening doors to opportunities and fresh ideas. It establishes a platform for cultivating relationships that can benefit all parties involved. Tools and maintenance representations underscore an essential facet of property management—an invaluable skill set necessary for the long-term value of the investment.

Interactive platforms and forums offer continuous learning and adaptation opportunities in the fast-evolving real estate sector. Investors, especially beginners, can glean insights, ask questions, and remain informed, ensuring their approach remains contemporary and yields the desired results. Ultimately, each illustration embodies the objectives of investing in rental property for beginners, lending it relatability and vibrancy.

—

A Beginner’s Journey in Real Estate Investment

Embarking on the path of real estate investment requires not just financial acumen, but also a strategic mindset and a willingness to learn. Investing in rental property for beginners might seem intimidating, but with the right guidance and preparation, it can be a rewarding venture. The journey begins not with your wallet, but with your mindset, an openness to learning from others, and developing your style of property management.

A key starting point is recognizing the diversity of rental properties available. From urban apartments to suburban homes, each type offers advantages and challenges. Your choice should be driven by market research, personal preferences, and financial capacity. Think of each property as a character in a story, with its demographic appeal and unique characteristics shaping its role in your investment narrative.

Building Connections: The Importance of Networking

Connecting with professionals and peers within the real estate community can provide invaluable insights and opportunities. Engaging in networking events, whether in person or virtual, allows beginners to learn from experienced investors, broaden their understanding of market dynamics, and receive advice on avoiding common missteps.

Managing Expectations: What Every Beginner Should Know

Managing expectations is vital in the early stages of investing in rental property for beginners. The path of property investment includes navigating tenant relations, maintenance challenges, and financial risks. By entering the investment journey with an optimistic yet realistic mindset, beginners equip themselves to handle these situations effectively, transforming potential challenges into opportunities for growth.

Leveraging Technology in Property Management

In today’s tech-driven world, embracing digital tools can significantly simplify property management tasks. Various applications and platforms can streamline rental payments, maintenance requests, and tenant communications. Investing in these solutions provides a competitive edge, granting property managers more time to focus on growth and improvement.

The Psychological Aspect of Investment

Understanding and managing the psychological component of investing is crucial for success. Confidence, patience, and resilience are traits pivotal in navigating the highs and lows of real estate investing. Novice investors should focus on building their confidence by continuously expanding their knowledge base and celebrating small achievements as stepping stones toward larger goals.

In conclusion, while investing in rental property for beginners can present an array of challenges, it also offers immense potential for growth and financial security. With dedication, strategic planning, and an open mindset, new investors can transform initial apprehensions into enthusiasm and success.