Budgeting Saving Money

H1: Budgeting Saving Money: A Journey to Financial Freedom

Read More : 7 Must-have Browser Extensions That Automatically Find Coupon Codes And Lower Prices!

Imagine a world where the constraints of financial pressure are a faint memory—a realm where saving money is second nature, and budgeting is the compass guiding you to endless possibilities. Welcome to the enchanting adventure of budgeting and saving money, where dreams transform into reality through disciplined planning and conscious choices. In this universe, every penny counts, and each saving story is a captivating tale of empowerment, resilience, and joy. So, buckle up as we embark on a storytelling odyssey that unveils the mysteries of financial savvy living!

Let’s set the scene with the enticing statistic that keeps us grounded: 71% of Americans have less than $1,000 in savings accounts. Crazy, right? Here’s where the real charm comes in—with a little bit of know-how and a sprinkle of financial fairy dust (also known as budgeting saving money), you can flip the script and build a castle of cash reserves. Picture the peace of sipping coffee without worrying about an unexpected flat tire, or the thrill of booking that impromptu vacation without breaking a sweat.

The journey of budgeting saving money is not an arduous hike up a financial mountain; it’s a leisurely stroll through a vibrant market, where your money is your trusted confidant. Investing time in creating a budget might sound like a task you’d rather avoid, but think of it as designing your personal treasure map. This map, though less treasure isle and more app-led finance planning, opens avenues previously unimagined.

But it’s not all serious soliloquies. Enter stage left: humor! Financial planning can be as enjoyable as a stand-up comedy show, minus the hecklers. There are apps now that make saving feel like a game—and who doesn’t love a good game? Turn your budgeting saving money challenge into a friendly competition with family and friends, sharing tips, celebrating victories, and yes, having a giggle over those small missteps inevitably made along the way.

Your debut act in this epic story should start today with clear intentions. Whether it’s saving for that nifty gadget, setting aside funds for a family vacation, or planning a comfortable retirement, the reigns of action rest in your hands. Snap a selfie, tweet your intention, and get ready for the applause at the end of the financial year! There’s a cheering audience waiting for your thunderous success story because everyone loves a good transformation tale.

H2: Understanding Budgeting and Saving Money—Introduction to Budgeting Saving Money

In a cluttered world filled with consumer temptations, budgeting saving money is the knight in shining armor. This disciplined approach doesn’t just create financial stability; it weaves a tapestry of security, comfort, and fulfillment in your life. Consider budgeting as the unsung hero of your financial narrative, one that provides harmony in what might otherwise be a chaotic economic existence. It’s the ultimate guide, the rudder steering your ship, the mentor whispering wise financial counsel in your ear.

Let’s flashback to bedtime stories—grandpa spinning tales of how he bought his first car or sent the kids to college without breaking the bank. The secret? A good old budget mingled with unwavering resolve. These real-life stories reflect the power of strategic monetary planning. They’re fascinating folklore intertwined with pragmatic wisdom passed across generations. Budgeting saving money is not a myth; it’s a timeless strategy that enables even the most inexperienced to master their financial domain.

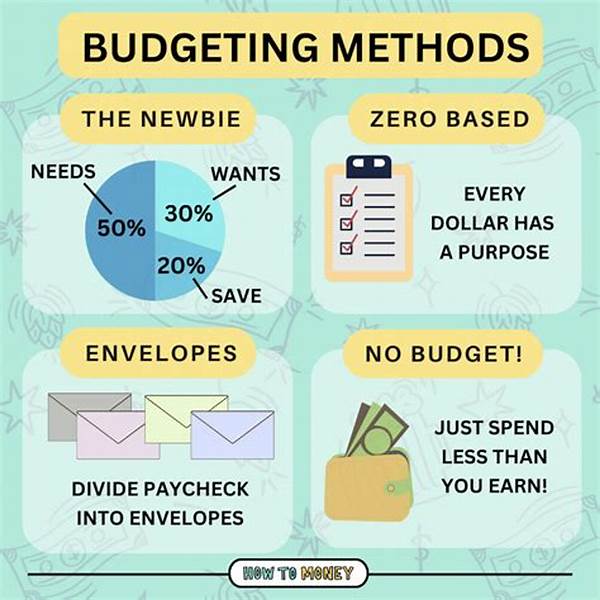

Imagine standing on a busy street corner, surrounded by life’s hustle and bustle. The gaps between elusive paychecks seem daunting, but fear not! Embrace the fun in budgeting saving money by transforming this intimidating exercise into a lively game with a vibrant interface filled with colorful charts and friendly notifications. Mint apps, YNAB, or good old Excel sheets—whatever fits your character in the budgeting saga becomes your trusty sidekick in this journey.

Budgets don’t just whisper numbers; they scream opportunity. Who doesn’t want a fulfilling life where spontaneous plans are a thrilling “yes” instead of an anxiety-inducing “no”? Here’s a twist in our little story: by creating separate buckets for funds, budgeting saving money enables you to save towards specific goals while simultaneously covering your daily expenses.

H2: The Role of Technology in Budgeting Saving MoneyH3: Emotional Intelligence in Managing Finances

In the modern age, budgeting saving money has morphed into an automated, digitized engagement thanks to technology. Whether you’re a millennial navigating student loans or a retiree safeguarding your nest egg, apps and tools have revolutionized the financial realm. They motivate, guide, and sometimes even scold us gently when we’re off-course—much like a loving robot parent!

Emotional intelligence plays a significant role too. Yes, it might sound quirky—what do emotions have to do with numbers? The answer lies in recognizing patterns, understanding temptations, and resisting those ‘spur-of-the-moment’ purchases when your heart skips a beat at the sight of a flashy sale. Just like a wise character in an epic tale, emotional intelligence leads you wisely through the labyrinth of monetary decision-making, ensuring your wallets stay happy and full.

In conclusion, the art of budgeting saving money is multifaceted—part discipline, part creativity, and a healthy sprinkle of emotional resilience. It’s not just about pinching pennies; it’s about living a splendid, financially fulfilled life where every “yes” to a new opportunity is backed by a solid, secured financial plan. Now, who doesn’t love a happy story with a prosperous ending?

—UL Topics Related to Budgeting Saving Money:

Discussion: Analyzing the Importance of Budgeting Saving Money

Sitting around a virtual round table, let’s engage in a compelling dialogue about why budgeting saving money should be a non-negotiable aspect of everyone’s life. Imagine the unpredictable storms of financial strain that brew without warning—an unexpected job loss, medical emergencies, or home repairs. Though daunting, these financial challenges are a part of life’s grand tapestry. Therefore, a robust budget is not just a luxury; it’s a necessity.

Budgeting saving money offers security in its purest form. In a 2022 survey, it was revealed that less than half of Americans could cover a $1,000 emergency with savings. Imagine living in a world where this statistic is flipped, where the majority are prepared for such contingencies. It’s not just a dream; it’s an attainable reality through diligent budgeting strategies and dedicated saving plans.

Empowering discussions around personal finances are the first steps to creating a culture of monetary literacy. Encouraging dialogues within communities cultivates a support system where tips, tricks, and testimonies of budgeting triumphs are shared openly. Our digital round table fosters an innovative exchange of ideas, breaking down the misperception that financial management is best kept behind closed doors.

H2: Establishing Strong Financial HabitsH3: Budgeting Tools and Resources

Through a continuous dialogue about budgeting and saving money, we inspire not only ourselves but also the upcoming generation into action. It’s an exciting cascade—one person’s enlightenment sparks a wildfire of financial acumen within a community. After all, in the grand tale of life, who wouldn’t want to play a role in a story where the hero defeats debt, rescues savings, and lives happily, financially ever after?

—UL Points Related to Budgeting Saving Money:

Implementing these strategies helps in building formidable defense mechanisms against life’s financial uncertainties.

Conclusion and Reflection

As we wrap up, the adventure of budgeting and saving money is not an isolated episode; it’s a dynamic, ongoing saga. Each moment spent plotting, planning, and prudently saving lays the foundation for future fortresses of financial stability. By surrounding yourself with tools, technology, and trusted financial allies, budgeting transforms from an obligation into a powerful enabler of life’s most extraordinary experiences.

Ultimately, your story in this budgeting saving money journey is your own, and the chapters are limited only by the depth of your dreams and the strength of your resolve. Now, step out, embrace this journey, and pave the way to a future defined not by constraints, but overflowing with opportunities and financial freedom!