How Gen Z Is Investing Differently In 2025

The winds of financial change are blowing, and they’re being driven by none other than Gen Z. How Gen Z is investing differently in 2025 is a fascinating story of empowerment, technology, and community. Unlike previous generations, Gen Z is not merely dipping their toes into the investment world; they’re jumping in with both feet, armed with cutting-edge digital tools and a fresh perspective on wealth. They’re breaking down traditional barriers and reinventing what it means to invest.

Read More : The Fake Diversification: Why Holding 10 Stocks In The Same Sector Isn’t Safe!

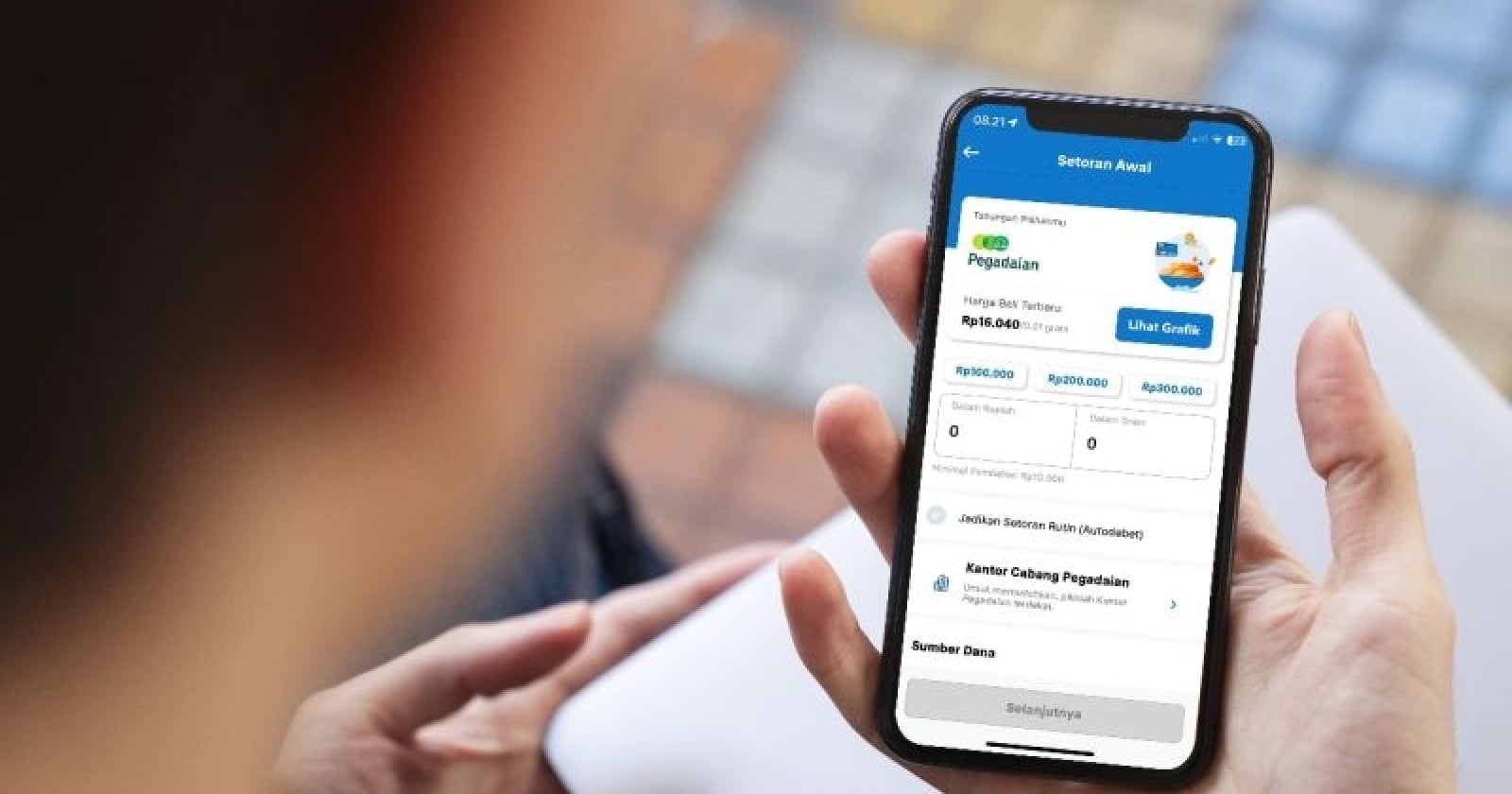

In 2025, the typical Gen Z investor isn’t hanging out at glossy, mahogany boardrooms or sipping cocktails at exclusive clubs. Instead, they’re likely nestled in their cozy apartment or a hip coworking space, using the latest AI-driven apps that demystify stocks, real estate, and even cryptocurrencies. These digital natives are not intimidated by the volatile nature of the market; rather, they’re embracing it with open arms. One could argue that they’re treating investing like a form of artistic expression, a canvas where they can depict their values—such as sustainability and social responsibility—while simultaneously crafting a financially secure future.

However, it’s not just the tools they use that set Gen Z apart. They are pioneering new methodologies and investment philosophies. For Gen Z, the journey matters just as much as the destination. There’s a significant emphasis on learning and understanding the process rather than just aiming for high returns. Social media platforms like TikTok and Instagram are flooded with influencers and everyday users alike, sharing insights, tips, and even regrets about their investment choices in an uncensored, unique cultural exchange.

The Rise of Community-Based Investing

The community element is another defining factor of how Gen Z is investing differently in 2025. This isn’t the “lone wolf of Wall Street” archetype; they thrive in shared experiences, often joining investment clubs or engaging in community-based crowdfunding initiatives that align with their interests and ethics. They’re not just looking to fatten their wallets; they’re also aiming to make the world a better place. These elements combine to form a new, dynamic investing landscape, rich in technology, values, and unparalleled community support.

—

Setting a New Financial Landscape

Gen Z has arrived on the financial scene with fresh eyes and minds unclouded by past methodologies. They question the status quo, employ new technologies, and prioritize transparency and ethics. How Gen Z is investing differently in 2025 is not just a headline; it’s a transformative movement reshaping financial markets worldwide.

Their approach isn’t just about making money but also about making an impact. For example, ESG (Environmental, Social, and Governance) investing is trendy, benefiting both portfolios and the planet. This generation welcomes volatility and sees it as an opportunity rather than a risk to be mitigated. They embrace the hustle and grind of pulling together resources from community efforts and digital platforms alike.

Embracing Evolution and Tech

If you’re trying to capture Gen Z as a target audience for investment products or services, understand this: they’re all about evolution and mobility. Companies must provide intuitive, frictionless platforms that are as dynamic as the users who engage with them. Platforms that empower Gen Z to invest seamlessly while offering educating resources are poised to succeed in this landscape.

Their inclination towards leveraging the most advanced technology is notable. Artificial Intelligence and Machine Learning play a significant role in their decision-making processes, offering insights that were once the purview of human analysts.

Details on How Gen Z is Investing in 2025

Discussion on Gen Z’s Distinct Approach

The discussion around how Gen Z is investing differently in 2025 wouldn’t be complete without exploring the social and cultural factors in play. They are not just digital natives but also digital pioneers, spearheading the way emerging technologies are normalized in investment practices. Gen Z has grown up alongside advancements, making them inherently adaptable to rapidly changing financial environments.

Furthermore, their investment strategies highlight a departure from the faceless, transactional nature of traditional investing. They’re bringing personality and individuality to the table, breaking down barriers across socio-economic lines. With a keen eye for emerging markets such as NFTs and blockchain technologies, they’re proving that diversification isn’t just a strategy for them; it’s a lifestyle.

This generational evolution is bolstered by the connective tissue of online networks and thriving community engagement, providing backdrops for both learning and executing complex financial strategies. Their openness to collective wisdom reflects a democratization of investing that fewer previous generations experienced.

Even traditional financial advisors are working to adapt, offering more personalized and digitally-assisted services to meet the needs of this burgeoning investor class. Collaborative rather than competitive, informative rather than secretive, Gen Z’s method is reflective of the age of information they matured in.

How Success is Measured Among Gen Z Investors

Beyond financial gains, Gen Z is investing in narratives and stories they believe in, supporting causes that reflect their views and values. Success here is measured not only by return on investment but also by tangible positive impacts on society and environment. Their financial thought-process encapsulates a unique blend of logic and emotion, pragmatism, and idealism.

Conclusion: The Road Ahead for Gen Z

The openness to constant change and adaptation marks Gen Z’s investment style. The evolution they bring not only sets them apart but also heralds transformations across the financial landscape itself. They challenge traditional notions of money, value, and power—creating new paradigms impactful enough to be studied by investors, scholars, and market analysts alike.

As we look ahead to future years, the question should not be whether Gen Z will shape the future of investing. Rather, it will be to what extent their influence will redefine each characteristic of what the investment world will become.

—

Illustrations of How Gen Z is Investing Differently in 2025

Painting the Picture of Tomorrow’s Wealth Management

Gen Z isn’t just participating in the financial world; they’re reimagining it. By blending both rational and emotional intelligence, they’re creating a uniquely effective strategy. Whether through memes or milestones, how Gen Z is investing differently in 2025 will continue to unfold a narrative that’s as compelling as it is instructive.

Their confidence in harnessing collective wisdom and cutting-edge technology means opportunities abound for both established financial titans and ambitious newcomers to innovate and evolve alongside this dynamic generation. In embracing these shifts, we don’t merely capture a part of the market—but a glimpse of the future itself.