Forbes Investing For Beginners

Forbes Investing for Beginners

Investing can often seem like a labyrinth of complicated terms and confusing statistics. It’s no wonder that many beginners feel intimidated by the idea of delving into the investment world. However, “Forbes Investing for Beginners” seeks to demystify this journey, breaking down barriers and offering practical advice for those ready to take their first steps into investing. Imagine standing at the gateway to financial independence, with dreams of increasing your wealth and securing a stable future. You’re not alone; millions share this aspiration, yet few know where to start. Whether it’s saving for retirement, a dream home, or simply building a safety net for life’s unpredictable turns, investing can be your road to achieving those goals. The question is, how do you begin? What investments are suitable for someone just out of the starting blocks?

Read More : Stock Investing For Beginners Uk

The answer lies in educating yourself about the basics of investing, understanding different asset classes, and recognizing your risk tolerance. With the right knowledge, the daunting world of stocks, bonds, mutual funds, and ETFs becomes a playground where you can build your financial future. “Forbes Investing for Beginners” aims to equip you with the confidence and skills to navigate this playground. With a sprinkle of humor, a dash of storytelling, and a healthy dose of practical guidance, this article is your insider’s guide to starting your investment journey.

Let’s embark on this journey of financial literacy, where the fusion of statistics, personal success stories, and step-by-step instructions come together to create an inviting and informative experience. It’s an investment in your future—a future where you hold the reins and steer your finances towards growth.

The Essential Tools for Beginners

Whether you’re a budding investor or you’re just curious about how to start investing, it’s essential to arm yourself with the right tools for the journey. First, understanding the power of compound interest can be a game-changer. This magical component can significantly increase your returns over time, allowing your wealth to grow exponentially. By starting early, even small investments can lead to substantial gains in the future.

Secondly, diversifying your portfolio is crucial. As the age-old saying goes, “Don’t put all your eggs in one basket.” By spreading your investments across various asset classes, such as stocks, bonds, and real estate, you can mitigate risks and maximize returns. This strategy is a vital part of “Forbes Investing for Beginners,” ensuring you maintain a balanced and resilient portfolio.

Lastly, setting clear financial goals is paramount. Without defined objectives, you might find yourself wandering aimlessly in the vast investing landscape. Whether your aim is purchasing a house, funding your child’s education, or leisurely retiring, having a clear goal will guide your investment choices.

Discussion on Forbes Investing for Beginners

Investing might sometimes feel like stepping into quicksand—one wrong move, and you’re in deeper than you intended. However, this doesn’t have to be the case. “Forbes Investing for Beginners” is like your friendly neighborhood map, guiding you through the zigs and zags of financial decisions. The beauty of starting as a beginner is the immense potential for growth and learning. It’s akin to discovering a new city, where each street and alley presents opportunities and challenges.

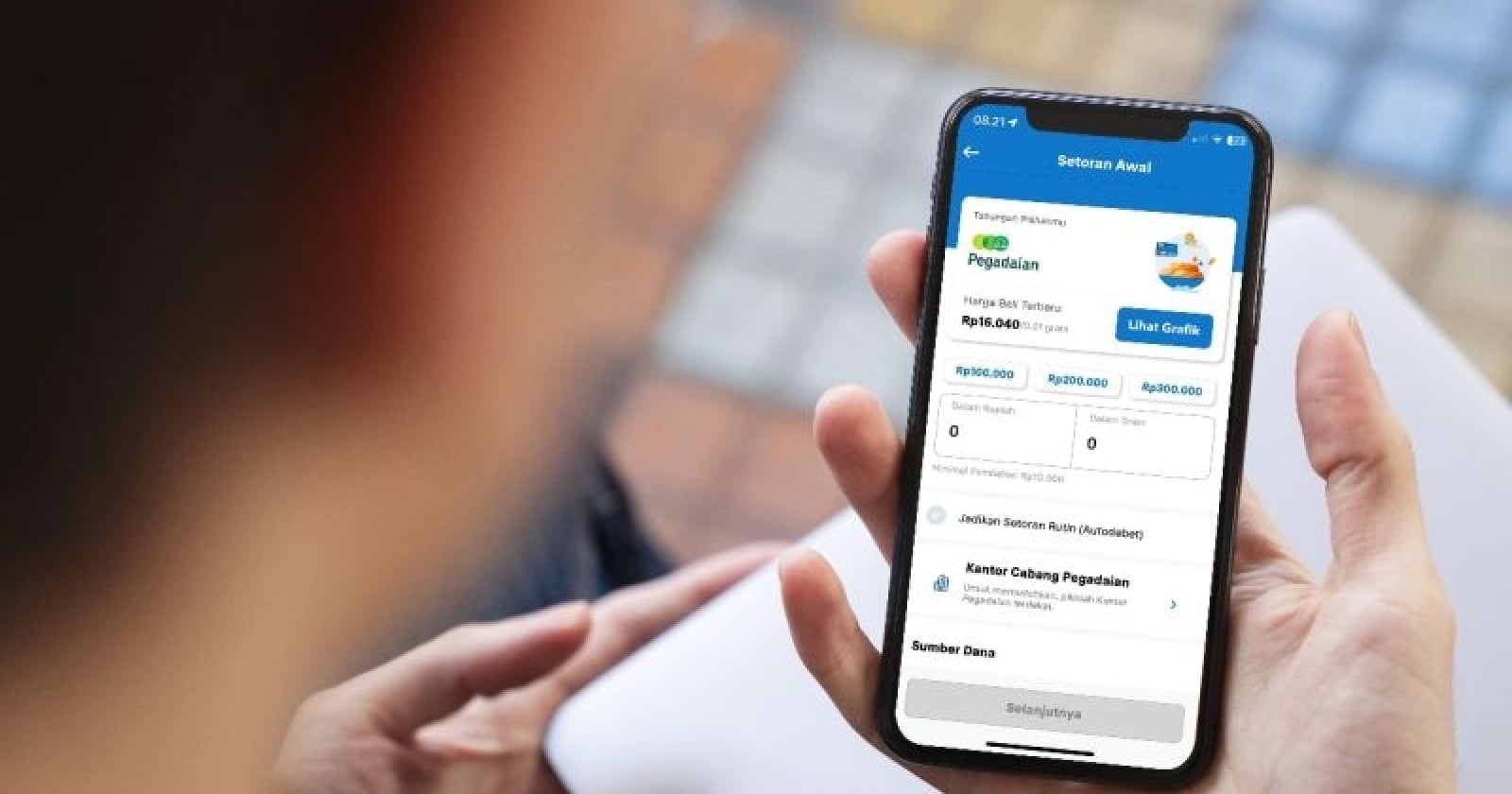

There’s a common misconception that investing is only for the wealthy. This couldn’t be further from the truth. With financial technology and information at our fingertips, the barriers to entry are lower than ever before. Micro-investing platforms and robo-advisors have paved the way for everyday individuals to dip their toes into the investment pool. These tools provide flexibility and tailored advice that aligns with your financial aspirations.

The Allure of Smart Investing

Smart investing is less about quick wins and more about strategic, long-term growth. Forbes has always championed the idea of calculated risk-taking—a kind of risk paired with research, understanding, and patience. For beginners, this means learning to read the market, understanding economic indicators, and keeping emotions in check when the market fluctuates. Remember, knee-jerk reactions can derail the most well-thought-out investment plan.

Overcoming the Fear of Investing

The fear of loss is the biggest deterrent for many potential investors. It’s natural to shudder at the prospect of losing hard-earned money. However, armed with the insights from “Forbes Investing for Beginners,” this fear can be transformed into informed caution and strategic decision-making. Imagine a warrior stepping onto the battlefield, not with dread, but with prowess, thanks to the right training and tools.

Dr. Emily Watson, a financial advisor, shares, “The thrill of watching your portfolio grow is unmatched. It’s about small, consistent actions that compound over time.” Her story resonates with many budding investors who recoil at market volatilities but learn to find stability and confidence in diversified investments.

So, as you stand on the precipice of your financial journey, let “Forbes Investing for Beginners” be your compass, aiding you in making decisions rooted in knowledge, foresight, and courage. The right mindset and strategies can transform anxieties regarding investments into a celebratory journey of wealth accumulation.

Actions to Take for Forbes Investing for Beginners

Building Blocks of Investing for Beginners

For new investors, the landscape can seem overwhelming with choices and decisions at every turn. The key is to build a strong foundation by starting small and steady. Many beginners are now tapping into user-friendly apps that simplify investment options and provide real-time updates. It’s a world where information is freely accessible, providing insights that were once confined to professionals.

To harness these opportunities, Forbes offers an array of resources and actionable tips catering specifically to beginners. Their expert opinions and success stories serve as inspiration and motivation to take those first critical steps. As the saying goes, knowledge is power, and in investing, it’s paramount for both avoiding pitfalls and seizing opportunities.

Why Beginners Shouldn’t Fear Investing

Often, the fear of the unknown inhibits action, yet understanding the dynamics of investing can turn fear into excitement. Adaptability is crucial as markets are ever-evolving, but the strategic guidance provided by Forbes ensures beginners are never navigating blindly. By drawing on the expertise and experiences shared, new investors can confidently step into this previously uncharted territory.

Forbes Investing for Beginners: Key Insights

Unlocking the Potential of Forbes Investing for Beginners

Embarking on the journey of investing offers a promising pathway toward financial freedom and security. What initially seems like a path fraught with challenges quickly transforms into a fulfilling experience with the right guidance. In this modern era, where information is pivotal, “Forbes Investing for Beginners” emerges as a beacon of knowledge, providing actionable advice, success stories, and strategic insights to navigate the treacherous waters of investing.

With the advent of digital platforms, investing is no longer restricted to the wealthy elite. Everyday individuals can now take control of their financial futures, starting small and growing over time. As new investors learn and adapt, the importance of remaining current and informed cannot be overstated. The resources provided by Forbes are invaluable in offering ongoing education—enhancing understanding, reducing risk, and maximizing returns.

Harness the wisdom of experienced investors who have tread this path before you. Absorb their stories and strategies, learn from their missteps, and leverage their knowledge to avoid common pitfalls. Adopting a strategic, measured approach to investing builds not just wealth but also confidence—an essential asset in the world of investing.

In conclusion, whether you’re looking to build wealth or simply seeking to know more about how Forbes can guide your investment journey, remember this: the first step is always the hardest, but it’s also the most important. Embrace the challenge, equip yourself with the right tools, and watch as opportunities unfold. Investing is not just about money; it’s about securing your future, forging paths previously unimagined, and finding joy in the process.