Investing Resources For Beginners

Investing Resources for Beginners

In today’s rapidly evolving financial landscape, the notion of securing your future through strategic investments can seem both daunting and exhilarating, especially for beginners. Whether your aim is to build additional streams of income, secure a retirement fund, or bolster financial literacy, navigating the world of investments is no small feat. However, with the right resources and guidance, investing can become a fulfilling journey rather than an intimidating task.

Read More : Mau Mulai Investasi? Ini 8 Aplikasi Reksadana Terbaik 2026 yang Paling Banyak Dipakai

Imagine waking up each morning not just working for money but having your money work for you. This isn’t just a pipe dream—it’s entirely feasible with the right approach and investing resources for beginners. Starting to invest doesn’t require you to possess vast knowledge about financial markets or the economy at large. Instead, it requires a measured approach, a willingness to learn, and the utilization of suitable resources tailored for novices. But where to begin?

Many beginners are hesitant to enter the world of investing due to the perceived complexity of financial instruments, terminologies, and potential risks involved. Yet, investing doesn’t have to be convoluted. Gone are the days when investing was a domain solely for financial experts or seasoned traders. With the democratization of information online and the plethora of platforms at our disposal, investing is more accessible than ever, regardless of one’s financial background or expertise.

One key to success is understanding that investing is not a one-size-fits-all venture. Each individual’s financial situation, goals, and risk tolerance are unique. This uniqueness calls for a personalized approach, focusing on employing effective investing resources for beginners. By understanding the basics, leveraging technology, and continually educating oneself, anyone can embark on a successful investment journey.

The Basics of Investing Resources for Beginners

Before diving headlong into the world of stocks, bonds, or mutual funds, it’s essential to familiarize oneself with several foundational concepts and tools that form the bedrock of investing.

—

Discussion on Investing Resources for Beginners

Building a Strong Foundation

When commencing your investment journey, it’s vital to understand that patience and education are your best friends. Beginners should focus on building a strong foundation by leveraging investing resources for beginners, which can guide them in making informed decisions. Starting with small, manageable investments is often advised because it allows one to learn without exposing themselves to significant risks.

Online courses, webinars, and investment apps tailored for novices are abundant, offering insights and strategies catering to varying levels of understanding. These resources often provide simulation environments where beginners can practice trading without real financial implications, reducing the stress and pressure of real-time market engagements.

The Power of Community and Mentorship

Another resource that often goes overlooked is the power of community. Engaging with others who share similar investment goals can significantly bolster one’s understanding and confidence. Online forums, social media groups, and local investment clubs are excellent avenues to connect with like-minded individuals. They offer not just camaraderie but also share firsthand experiences and strategies that books and courses might not offer.

Seeking mentorship from seasoned investors can further enhance a beginner’s understanding. Mentors provide valuable perspective, offer advice based on personal successes and failures, and help navigate the overwhelming information available. This guidance can be instrumental in avoiding common pitfalls and ensuring steady progress.

Overcoming Psychological Barriers

For many, the fear of loss is a binding psychological barrier to investing. Market volatility and financial jargon can induce anxiety and discourage potential investors. However, with the right mindset and resources, these challenges can be overcome. Investing resources for beginners often emphasize the importance of setting clear goals, maintaining a diversified portfolio, and understanding one’s risk appetite to alleviate fears and build confidence.

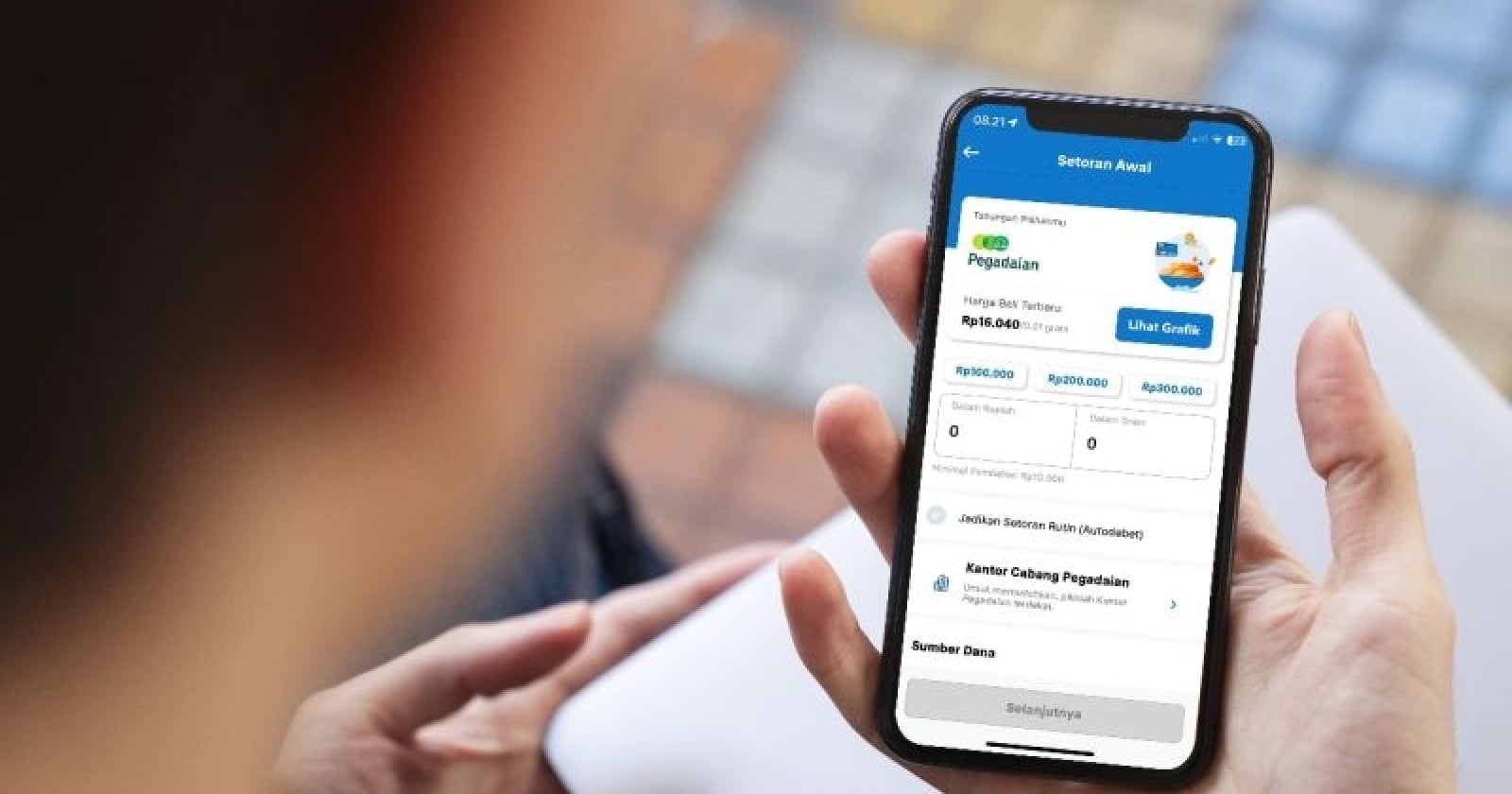

Technology, too, plays a pivotal role in supporting beginners. Automated advisories, or “robo-advisors,” and AI-driven platforms provide personalized investment plans based on individual goals and preferences. These tools minimize human error and emotional decision-making, leading to more rational investment choices.

Tools of the Trade

The variety of available platforms and tools fortifies confidence among novice investors. From trading apps providing real-time data and analytics to financial news websites offering market trends and tips, the wealth of resources available is staggering. Furthermore, podcasts and YouTube channels dedicated to educating beginners demystify investing concepts through engaging, easily digestible content.

Investing resources for beginners should not only inform but inspire action. The dynamic world of investment is not without its risks, but well-informed decisions backed by robust resources can lead to substantial benefits. Enthusiastic beginners ought to capitalize on these tools, transitioning from passive readers to active participants in their financial destinies.

Setting Realistic Expectations

While investment success stories are plentiful, beginners must temper expectations and approach investing with a long-term perspective. Utilizing resources to gain a comprehensible understanding of market dynamics ensures a more fruitful journey. Accepting that losses are part of the learning curve is crucial, as is celebrating small victories along the way.

Resources for Sustained Learning

Continual education remains a cornerstone of successful investing. As markets evolve, so too should an investor’s strategies and knowledge base. Investing resources for beginners act as stepping stones to more advanced learning opportunities, whether through graduate-level courses, professional consultations, or advanced financial literature.

In the ever-shifting world of finance, staying curious and adaptable is the ultimate tool for novice investors looking to make their mark.

—

Topics Related to Investing Resources for Beginners

Investing Resources and Their Impact on Beginners

For those first venturing into the realm of investments, the assortment of available resources can make a significant difference in success and confidence. Investing resources for beginners often encompass a blend of educational tools, technology, and community support designed to ease the learning curve and build a solid framework for growth.

Beginners should start by utilizing educational platforms that cater specifically to their level of understanding. These platforms tend to offer courses, e-books, and webinars that break down complex concepts into digestible segments, making the process more manageable and less intimidating. The investing landscape is vast and constantly evolving, hence why a structured learning path is invaluable.

Analyzing Beginner-Friendly Tools

Investing is not merely about throwing money into stocks or funds; it’s about making informed decisions backed by data and insights. Modern-day tools provide access to real-time data, market analyses, and predictions, allowing beginners to make educated decisions. Applications like stock simulators give beginners a risk-free environment to understand market dynamics, equipping them with practical knowledge before diving into actual investments.

Active participation in online communities and investment clubs also plays a critical role. These platforms foster peer learning, sharing of diverse insights, and firsthand accounts from experienced investors. Understanding real-world application rather than just theoretical knowledge can vastly improve a beginner’s acumen and readiness. The combination of these resources sets the foundation for a lucrative and knowledgeable investing journey.

—

Expanding Knowledge Through Investing Resources

Tailored Strategies for Beginners

Investing resources for beginners predominantly involve understanding the factors that influence the financial markets and the economical landscape. Initiatives like beginner-centric investment workshops offer personalized strategies that cater to individual financial goals and circumstances. These workshops are designed to create an interactive learning environment where beginners feel supported and less overwhelmed by financial complexities.

Moreover, leveraging the expertise of financial advisors can transform how beginners approach their investment strategies. By providing tailored advice that aligns with personal financial objectives and market conditions, these professionals ensure a more personalized investment experience.

Real Insights Through Data

The analytic capabilities offered by modern financial tools enable beginners to gain insights into market trends and potential opportunities. Platforms like Bloomberg, CNBC, and other financial news outlets provide detailed analyses of current market situations, trends, and forecasts, empowering beginners with relevant information. Comprehending this data allows novices to anticipate market movements and adapt their strategies accordingly. Additionally, investment resources for beginners should encourage an appreciation for ongoing education, motivating learners to continually stay abreast of new developments and trends.

The Role of Emotional Intelligence

Emotional stability is an underappreciated aspect of successful investing. It is essential for beginners to cultivate emotional intelligence while learning about investments. The ups and downs of the market are inevitable; how one reacts can influence their long-term success. Investing resources for beginners should incorporate insights into managing emotions, setting realistic expectations, and maintaining a positive outlook even during downturns.

By placing emphasis on controlled emotional responses and cultivating a disciplined approach to decision-making, beginners can develop a resilient investing mindset. This long-term vision not only aids in nurturing sustainable investment portfolios but also strengthens financial acumen.

Embracing a Learning Culture

Investing is a continuous journey, with each day offering new lessons and insights. Beginners should adopt a culture of constant learning and adaptation. By regularly engaging with new resources, attending workshops, and participating in investment discourses, they remain updated with the latest developments and best practices. Staying curious and open to learning new strategies ensures that beginners mature into savvy investors who can navigate the complexities of financial markets with assurance and skill.

The world of investing holds endless opportunities for those willing to educate themselves and remain persistent. With the abundant investing resources for beginners available today, there’s every reason to approach the investment landscape with confidence and optimism. As one embarks on this journey, the blend of knowledge, discipline, and adaptability becomes the cornerstone of not just financial growth, but also lifelong learning.

—

9 Tips for Investing Resources for Beginners

Cultivating a Solid Financial Foundation

Investing offers a pathway to financial freedom and growth. However, beginners often face challenges in navigating this complex landscape. The importance of investing resources for beginners cannot be overstated, as it offers tailored information and guidance crucial for building a robust financial foundation.

For beginners, the initial steps into investing should focus on education and understanding. This involves participating in online courses and webinars tailored to novices, which are designed to break down complex financial concepts into understandable lessons. Additionally, actively engaging with investment simulating platforms allows beginners to practice and refine their investment strategies without facing real-world consequences.

Engaging with Resourceful Communities

Beyond individual learning, joining investment groups or forums can offer significant benefits. Community engagement provides opportunities to learn from peers, share experiences, and gather diverse perspectives. This shared knowledge can often shed light on practical aspects of investing that might be missing from theoretical learning.

Equipping oneself with a mix of educational resources, technological tools, and community support creates a base strong enough to withstand the challenges of the investing world. As one continually learns and adapts, the journey of investing transforms from a daunting task to an empowering experience, powered by knowledge and strategic use of available resources tailored for beginners.

The abundance of investing resources for beginners in today’s digital age is unparalleled, giving anyone the opportunity to embark on a prosperous investment journey armed with insight and confidence.